Form Wv/bcs-1 - Business Investment And Jobs Expansion Credit And Corporate Headquarters Relocation Credit (Super Credits) - Page 15

ADVERTISEMENT

Line i.

Subtract Line h from Line g. (This number may never be less than zero). Also, enter this amount in Part

VII, Section 1, Line c for the applicable tax year. This number represents the total amount of rebate available

to be carried forward to future years.

The amount of applied rebate for the current taxable year is the amount of rebate carried forward

from prior years plus the lesser of:

1. The unused portion of the annual credit allowance (Part V, Section 2, Line c); or

2. The maximum rebate allowable (Part V, Section 2, Line d).

PART VI - FREE-UP CREDIT CALCULATION SCHEDULE

(For Taxpayers subject to the Minimum Severance Tax on Coal)

Line 1. Enter total tons produced for sale on or before May 31, 1993 in Column 1 and total tons produced for sale

on or after June 1, 1993 in Column 2. Add Columns 1 and 2 and enter the total tons sold in column 3.

Line 2. Multiply Line 1, Column 1, by $0.50 and Line 1, Column 2 by $0.75. Add Columns 1 and 2 and enter in

Column 3.

Line 3. Enter the total from Schedule A, Line 1, WV/SEV 401-C, Coal Severance Tax Return.

Line 4. Enter the total from Schedule A, Line 2A plus Line 2F less any claim of Industrial Expansion and

Revitalization, Research and Development, Coal Loading Facility and/or Capital Company Credits.

Line 5. Subtract Line 4 from Line 3.

Line 6. Multiply Line 5 by 0.93.

Line 7. Subtract the amount in Column 3, Line 6, from the amount in Column 3, Line 2, and enter the difference.

(If less than zero, enter zero).

Line 8. Enter the amount on Line 2, Column 2 divided by the number 3.

Line 9. Enter in Column 3 the lessor of Lines 7 or 8. Enter this amount on applicable Line, Part IV, Column 12 of

Tax Credit Computation Schedule.

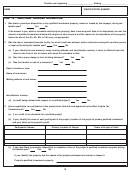

PART VII - RECAP OF ANNUAL CREDIT APPLICATION

Section 1

Line a.

Enter the annual credit allowance for Business Investment and Job Expansion Credit and Corporate

Headquarters Relocation and Business Investment and Jobs Expansion Credit for qualified invest-

ments for which the cost is not quantifiable. (The sum of Part II, Section 1, Line 5 and Section II, Line

7) on Line a.

Line a (1). Enter your first year of credit utilization on Line a (1). If you have a multiple year project certification,

skip Lines a and a (1) and complete Lines b (1) through Line b (4).

Line b (1). If you received a multiple year project certification then enter your annual credit allowance for

investments placed into service during the first taxable year. Include any annual credit allowance for

which a yearly computation was required. Also enter the applicable year in the space provided.

Line b (2). Enter your annual credit allowance for investments placed into service during the second taxable year

(if applicable). Include any annual credit allowance for which a yearly computation was required.

Line b (3). Enter your annual credit allowance for investments placed in service during the third taxable year (if

applicable). Include any annual credit allowance for which a yearly computation was required.

Line b (4). Add the amounts on Lines b (1), b (2), and b (3) and enter the result on Line 4. This is the amount of

credit available for the current year. Note, this credit is only available to taxpayers who obtain a multiple

year project certification from the Tax Commissioner. All others must use the instructions for Line a to

compute their credit. Depending upon the type of credit period, i.e. single year or multiple year, the

15

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30