Form Wv/bcs-1 - Business Investment And Jobs Expansion Credit And Corporate Headquarters Relocation Credit (Super Credits) - Page 17

ADVERTISEMENT

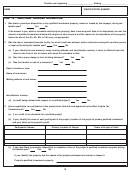

WV/BCS-1

Rev. March/2004

Taxable year beginning ______________________, Ending _______________________

NAME

IDENTIFICATION NUMBER

STREET ADDRESS

CITY, TOWN, OR POST OFFICE

STATE

ZIP CODE

WEST VIRGINIA BUSINESS INVESTMENT AND JOBS EXPANSION TAX CREDIT OR

CORPORATE HEADQUARTERS RELOCATION CREDIT

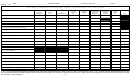

PART I - QUALIFIED INVESTMENT PLACED IN SERVICE OR

Date Placed In

(1)

(2)

(3)

USE IN THIS TAXABLE YEAR IN WEST VIRGINIA

Service or Use

Cost or

Applicable

Qualified

Other Basis

Percentage

Investment

MONTH/DAY/YEAR

Col. 1 X Col. 2

Section 1. PURCHASED PROPERTY

(a) Land

100%

(1) Natural resources in place*

100%

(2) Land

(b) Buildings and Other Improvements to Real Property

0%

(1) Useful life less than 4 years

33.33%

(2) 4 years but less than 6 years

66.66%

(3) 6 years but less than 8 years

100%

(4) 8 years or more

(c) Machinery, Equipment, and Other Depreciable or

Amortizable Tangible Personal Property**

0%

(1) Useful life less than 4 years

33.33%

(2) 4 years but less than 6 years

66.66%

(3) 6 years but less than 8 years

(4) 8 years or more

100%

(d)TOTAL

Section 2. LEASED PROPERTY

(a) Land

(1) Natural resources in place capable of 10 or more

100%

years of sustained production

100%

(2) Land with primary lease term of 10 or more years

(b) Buildings and Other Improvements to Real Property

(1) Primary lease term and useful life of property 10

100%

years or more

(c) Machinery, Equipment, and Other Depreciable or Amortizable

Tangible Personal Property

0%

(1) Primary lease term or useful life less than 4 years

33.33%

(2) Primary lease term and useful life of property 4 to 6 years

66.66%

(3) Primary lease term and useful life of property 6 to 8 years

(4) Primary lease term and useful life of property 8 years or more

100%

(d) TOTAL

* Natural resources in place must be capable of sustained production for a period of ten (10) or more years. Natural resources in place or leased natural resources generally

apply only to investments in place prior to 1990.

** Tangible personal property that is eligible for depreciation or amortization for federal income tax purposes having a useful life (economic life) of four (4) or more years.

1

17

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30