Form Wv/bcs-1 - Business Investment And Jobs Expansion Credit And Corporate Headquarters Relocation Credit (Super Credits) - Page 18

ADVERTISEMENT

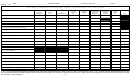

Date Placed In

(1)

(2)

(3)

Service or Use

* Cost or

Applicable

Qualified

Other Basis

Percentage

Investment

MONTH/DAY/YEAR

Col. 1 X Col. 2

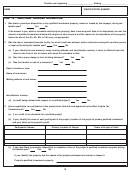

Section 3. TRANSFERRED PROPERTY

(a) Owned Machinery, Equipment, and Other Tangible Personal

Property

0%

(1) Remaining useful life less than 4 years

33.33%

(2) Remaining useful life 4 to 6 years

66.66%

(3) Remaining useful life 6 to 8 years

100%

(4) Remaining useful life 8 or more years

(b) Leased Machinery, Equipment, and Other Tangible Personal

Property

(1) Remaining years of primary lease term and useful life less

0%

than 4 years

(2) Remaining years of primary lease term and useful life 4 to 6

33.33%

years

(3) Remaining years of primary lease term and useful life 6 to 8

66.66%

years

(4) Remaining years of primary lease term and useful life 8 years

or more

100%

(c)TOTAL

Section 4. REASONABLE AND NECESSARY EXPENSES

TO RELOCATE CORPORATE HEADQUARTERS

(a)

100%

(1) .......................................................................................................

100%

(2) .......................................................................................................

(3) .......................................................................................................

100%

(4) .......................................................................................................

100%

(5) .......................................................................................................

100%

(b)TOTAL

Section 5. SUMMARY OF QUALIFIED INVESTMENT

(a) Amount from Part 1, Section 1, line (d), Column 3

(b) Amount from Part 1, Section 2, line (d), Column 3

(c) Amount from Part 1, Section 3, line (c), Column 3

(d) Amount from Part 1, Section 4, line (b), Column 3

(e) Total [add lines (a) (b) (c) and (d)]

Date Placed In

(1)

(2)

(3)

ONLY FOR PROPERTY INITIALLY PLACED INTO SERVICE

Service or Use

*Cost or

Applicable

Qualified

PRIOR TO 1/1/90

Other Basis

Percentage

Investment

MONTH/DAY/YEAR

Col. 1 X Col. 2

Section 6. LEASED PROPERTY - FOR WHICH THE COST

IS

NOT QUANTIFIABLE AT THE OUTSET OR

WHICH VARIES ANNUALLY**

(a) Natural resources in place - Royalties actually paid to owner of

100%

the natural resource during this taxable year

(b) Real property - Payments made during this taxable year

100%

(c) Tangible personal property

0%

(1) Primary lease term or useful life of property less than 4 years

33.33%

(2) Primary lease term or useful life of property 4 to 6 years

66.66%

(3) Primary lease term or useful life of property 6 to 8 years

100%

(4) Primary lease term or useful life of property 8 years or more

(d) TOTAL

*

Adjusted cost or other basis is original cost or other basis, less straight line depreciation for period of time the taxpayer used the transferred property outside this

State. In the case of leased property it is the rent reserved for the remainder of the primary term of the lease.

**

Natural resources in place must be capable of sustained production for a period of ten (10) or more years. Any other qualifying real property must have a primary lease

2

term of ten (10) or more years.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30