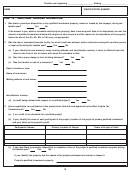

Form Wv/bcs-1 - Business Investment And Jobs Expansion Credit And Corporate Headquarters Relocation Credit (Super Credits) - Page 25

ADVERTISEMENT

Taxable year beginning ______________________, Ending _______________________

NAME

IDENTIFICATION NUMBER

PART VI - FREE-UP CREDIT COMPUTATION SCHEDULE

NOTE: Available only to Taxpayers subject to the Minimum Severance Tax on Coal

Column 1

Column 2

Column 3

Prior to June 1, 1993

On or After June 1, 1993

TOTAL

1.

Total tons sold

+

2.

Tax:

Line 1 x $.50 =

Line 1 x $.75 =

3.

WV/SEV401-C Schedule A, Line 1

4.

WV/SEV401-C Schedule A, Line 2A plus Line 2F

(11-13C credits plus Annual Exemption)

5.

Net Severance Tax (Line 3 minus Line 4)

6.

State portion (Line 5 above x .93)

7.

NET MINIMUM TAX (Line 2, Column 3 minus Line 6,

if less than zero, enter zero)

8.

Line 2, Column 2 Tax Computation of Tons Sold @ $.75 divided by 3

9.

AVAILABLE FREE-UP CREDIT (The lessor of Lines 7 or 8)

Enter this amount on applicable line(s), Column 12, of Tax Credit Computation Schedule

NOTE: "Free-up Credit" may be used against Business Franchise Tax, Corporation Net Income Tax and Personal Income Tax

liabilities. Any unused free-up credit must be forfeited by the taxpayer and may not be carried to any other tax year.

9

23

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30