Form Wv/bcs-1 - Business Investment And Jobs Expansion Credit And Corporate Headquarters Relocation Credit (Super Credits) - Page 20

ADVERTISEMENT

NAME

IDENTIFICATION NUMBER

(1)

(2)

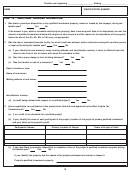

PART III -NEW JOBS/PAYROLL FACTOR COMPUTATION

Number of

Payroll of

Employees

Col. 1 Employees

Section 1.

New Jobs

Column 1

Column 2

1. What was the taxpayer's total employment in West Virginia prior to this qualified

investment being placed in service or use?

2. What was the taxpayer's total employment in West Virginia during the taxable

year?

3. What was the taxpayer's total average employment in West Virginia during the

taxable year?

4. How many new jobs filled by West Virginia domiciled residents are/will be directly

attributable to this qualified investment?

5. How many jobs filled by both West Virginia residents and nonresidents working in

the State, including new jobs filled by new employees, are directly attributable to

this qualified investment?

Section 2.

Payroll Factor Computation

Divided

=

by

(Part III Section 1, Line 5,

(Part III Section 1, Line 2,

(Rounded to six decimals)

Column 2)

Column 2)

(Compensation paid to new

(Compensation paid to all

employees hired as a result

West Virginia employees

of the New Investment)

of the taxpayer)

If the use of this payroll factor computation results in a significant distortion of tax liability attributable to the investment,

the Tax Commissioner may prescribe use of an alternative method for determining such tax liability.

4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30