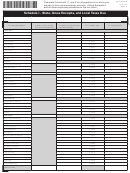

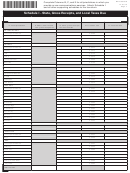

Form Dr-700016 - Florida Communications Services Tax Return Page 11

ADVERTISEMENT

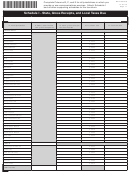

Complete Columns B, C, and E for all jurisdictions in which you

DR-700016S

R. 01/15

provide or use communications services. Attach Schedule I

Page 11

and all other supporting schedules to the tax return.

Schedule I - State, Gross Receipts, and Local Taxes Due

Business name

Business partner number

B. Taxable sales subject

C. Taxable sales subject

A. Local jurisdiction

to 6.65% state tax and

to 2.37% gross receipts

D. Local tax rate

E. Local tax due

.15% gross receipts tax

tax and local tax

PALM BEACH

Unincorporated area

0.0572

Atlantis

0.0510

Belle Glade

0.0512

Boca Raton

0.0542

Boynton Beach

0.0522

Briny Breezes

0.0522

Cloud Lake

0.0232

Delray Beach

0.0522

Glen Ridge

0.0522

Golf

0.0522

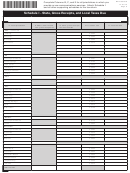

Greenacres

0.0644

Gulf Stream

0.0522

Haverhill

0.0260

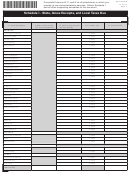

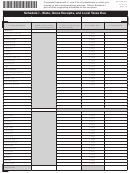

Highland Beach

0.0522

Hypoluxo

0.0592

Juno Beach

0.0522

Jupiter

0.0522

Jupiter Inlet Colony

0.0522

Lake Clarke Shores

0.0522

Lake Park

0.0532

Lake Worth

0.0522

Lantana

0.0542

Loxahatchee Groves

0.0522

Manalapan

0.0160

Mangonia Park

0.0562

North Palm Beach

0.0522

Ocean Ridge

0.0200

Pahokee

0.0522

Palm Beach

0.0522

Palm Beach Gardens

0.0350

Palm Beach Shores

0.0552

Palm Springs

0.0532

Riviera Beach

0.0522

Royal Palm Beach

0.0522

South Bay

0.0510

South Palm Beach

0.0560

Tequesta

0.0522

Wellington

0.0522

West Palm Beach

0.0542

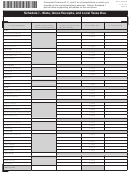

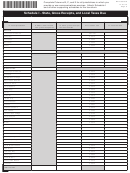

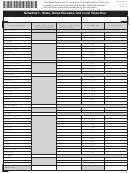

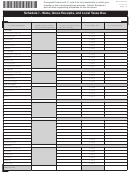

PASCO

Unincorporated area

0.0244

Dade CIty

0.0582

New Port Richey

0.0622

Port Richey

0.0570

San Antonio

0.0140

St. Leo

0.0582

Zephyrhills

0.0612

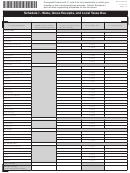

PAGE TOTAL

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24