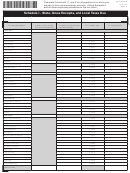

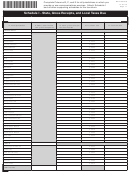

Form Dr-700016 - Florida Communications Services Tax Return Page 4

ADVERTISEMENT

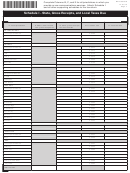

Complete Columns B, C, and E for all jurisdictions in which you

DR-700016S

R. 01/15

provide or use communications services. Attach Schedule I

Page 4

and all other supporting schedules to the tax return.

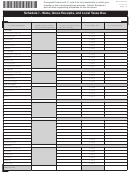

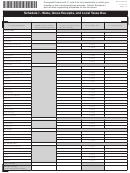

Schedule I - State, Gross Receipts, and Local Taxes Due

Business name

Business partner number

B. Taxable sales subject

C. Taxable sales subject

A. Local jurisdiction

to 6.65% state tax and

to 2.37% gross receipts

D. Local tax rate

E. Local tax due

.15% gross receipts tax

tax and local tax

BROWARD

Unincorporated area

0.0522

Coconut Creek

0.0522

Cooper City

0.0522

Coral Springs

0.0522

Dania Beach

0.0532

Davie

0.0520

Deerfield Beach

0.0522

Fort Lauderdale

0.0522

Hallandale Beach

0.0522

Hillsboro Beach

0.0120

Hollywood

0.0522

Lauderdale Lakes

0.0532

Lauderdale-by-the-Sea

0.0522

Lauderhill

0.0522

Lazy Lake

0.0060

Lighthouse Point

0.0622

Margate

0.0532

Miramar

0.0522

North Lauderdale

0.0522

Oakland Park

0.0542

Parkland

0.0522

Pembroke Park

0.0522

Pembroke Pines

0.0542

Plantation

0.0522

Pompano Beach

0.0522

Sea Ranch Lakes

0.0522

Southwest Ranches

0.0522

Sunrise

0.0522

Tamarac

0.0522

West Park

0.0522

Weston

0.0522

Wilton Manors

0.0562

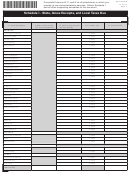

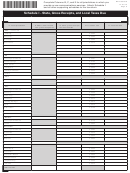

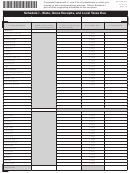

CALHOUN

Unincorporated area

0.0264

Altha

0.0602

Blountstown

0.0602

CHARLOTTE

Unincorporated area

0.0582

Punta Gorda

0.0582

CITRUS

Unincorporated area

0.0224

Crystal River

0.0522

Inverness

0.0532

PAGE TOTAL

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24