Form Dr-700016 - Florida Communications Services Tax Return Page 12

ADVERTISEMENT

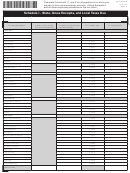

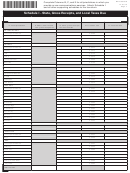

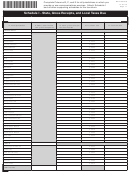

Complete Columns B, C, and E for all jurisdictions in which you

DR-700016S

R. 01/15

provide or use communications services. Attach Schedule I

Page 12

and all other supporting schedules to the tax return.

Schedule I - State, Gross Receipts, and Local Taxes Due

Business name

Business partner number

B. Taxable sales subject

C. Taxable sales subject

A. Local jurisdiction

to 6.65% state tax and

to 2.37% gross receipts

D. Local tax rate

E. Local tax due

.15% gross receipts tax

tax and local tax

PINELLAS

Unincorporated area

0.0582

Belleair

0.0582

Belleair Beach

0.0660

Belleair Bluffs

0.0582

Belleair Shore

0.0300

Clearwater

0.0572

Dunedin

0.0592

Gulfport

0.0672

Indian Rocks Beach

0.0290

Indian Shores

0.0582

Kenneth City

0.0570

Largo

0.0622

Madeira Beach

0.0632

North Redington Beach

0.0572

Oldsmar

0.0642

Pinellas Park

0.0600

Redington Beach

0.0600

Redington Shores

0.0582

Safety Harbor

0.0712

Seminole

0.0582

South Pasadena

0.0632

St. Petersburg

0.0622

St. Pete Beach

0.0630

Tarpon Springs

0.0632

Treasure Island

0.0582

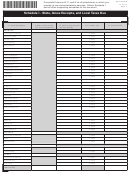

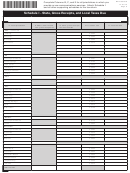

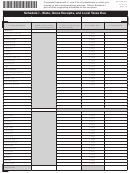

POLK

Unincorporated area

0.0582

Auburndale

0.0582

Bartow

0.0672

Davenport

0.0412

Dundee

0.0632

Eagle Lake

0.0602

Fort Meade

0.0592

Frostproof

0.0592

Haines City

0.0582

Highland Park

0.0060

Hillcrest Heights

0.0170

Lake Alfred

0.0582

Lake Hamilton

0.0432

Lake Wales

0.0582

Lakeland

0.0703

Mulberry

0.0582

Polk City

0.0582

Winter Haven

0.0692

PAGE TOTAL

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24