Form Dr-700016 - Florida Communications Services Tax Return Page 8

ADVERTISEMENT

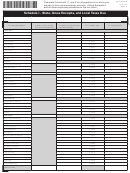

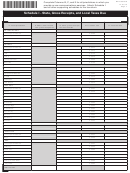

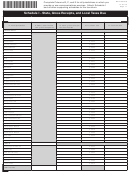

Complete Columns B, C, and E for all jurisdictions in which you

DR-700016S

R. 01/15

provide or use communications services. Attach Schedule I

Page 8

and all other supporting schedules to the tax return.

Schedule I - State, Gross Receipts, and Local Taxes Due

Business name

Business partner number

B. Taxable sales subject

C. Taxable sales subject

A. Local jurisdiction

to 6.65% state tax and

to 2.37% gross receipts

D. Local tax rate

E. Local tax due

.15% gross receipts tax

tax and local tax

LAKE - continued

Leesburg

0.0582

Mascotte

0.0582

Minneola

0.0582

Montverde

0.0570

Mount Dora

0.0582

Tavares

0.0592

Umatilla

0.0582

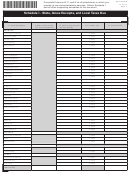

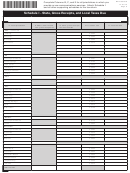

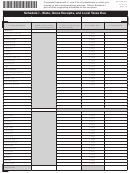

LEE

Unincorporated area

0.0361

Bonita Springs

0.0182

Cape Coral

0.0522

Fort Myers

0.0522

Fort Myers Beach

0.0522

Sanibel

0.0522

LEON

Unincorporated area

0.0602

Tallahassee

0.0690

LEVY

Unincorporated area

0.0234

Bronson

0.0300

Cedar Key

0.0260

Chiefland

0.0572

Fanning Springs

0.0612

Inglis

0.0572

Otter Creek

0.0120

Williston

0.0572

Yankeetown

0.0622

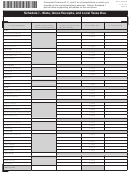

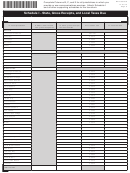

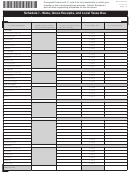

LIBERTY

Unincorporated area

0.0140

Bristol

0.0602

MADISON

Unincorporated area

0.0264

Greenville

0.0542

Lee

0.0602

Madison

0.0602

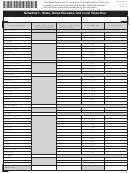

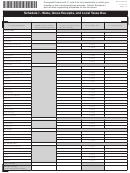

MANATEE

Unincorporated area

0.0214

Anna Maria

0.0552

Bradenton

0.0602

Bradenton Beach

0.0602

Holmes Beach

0.0552

Longboat Key

0.0552

Palmetto

0.0572

PAGE TOTAL

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24