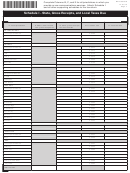

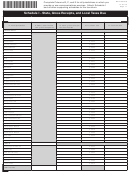

Form Dr-700016 - Florida Communications Services Tax Return Page 15

ADVERTISEMENT

If you complete Schedule I, then you must also complete

DR-700016S

R. 01/15

Summary of Schedule I. Attach the schedule, summary, and

Page 15

all other supporting schedules to the tax return.

Summary of Schedule I - State, Gross Receipts, and Local Taxes Due

Business name

Business partner number

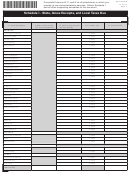

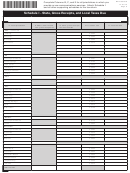

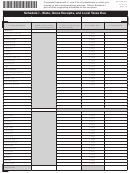

F.

G.

H.

6.65% State Tax and

2.37% Gross Receipts Tax

Local Tax

.15% Gross Receipts Tax

1. Taxable sales

4. Taxable sales

(Col. B grand

(Col. C grand

total)

total)

2. State tax rate

(.0665) and

5. Gross receipts

.068

.0237

gross receipts

tax rate (.0237)

tax rate (.0015)

3. State 6.65%

Local tax due

7.

plus .15%

6. Gross receipts

(Column E grand

gross receipts

tax due (Enter

total). (Enter

tax due (Enter

this amount on

this amount on

this amount on

Page 1, Line 2)

Page 1, Line 3)

Page 1, Line 1)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24