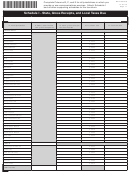

Form Dr-700016 - Florida Communications Services Tax Return Page 9

ADVERTISEMENT

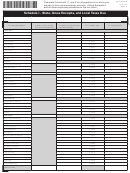

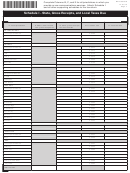

Complete Columns B, C, and E for all jurisdictions in which you

DR-700016S

R. 01/15

provide or use communications services. Attach Schedule I

Page 9

and all other supporting schedules to the tax return.

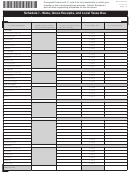

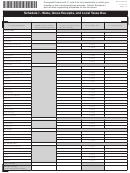

Schedule I - State, Gross Receipts, and Local Taxes Due

Business name

Business partner number

B. Taxable sales subject

C. Taxable sales subject

A. Local jurisdiction

to 6.65% state tax and

to 2.37% gross receipts

D. Local tax rate

E. Local tax due

.15% gross receipts tax

tax and local tax

MARION

Unincorporated area

0.01735

Belleview

0.0512

Dunnellon

0.0522

McIntosh

0.0522

Ocala

0.0522

Reddick

0.0130

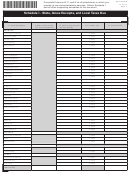

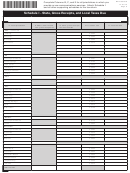

MARTIN

Unincorporated area

0.0184

Jupiter Island

0.0522

Ocean Breeze

0.0220

Sewalls Point

0.0312

Stuart

0.0522

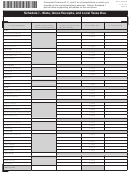

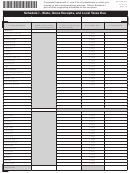

MIAMI-DADE

Unincorporated area

0.0572

Aventura

0.0570

Bal Harbour Village

0.0572

Bay Harbor Islands

0.0572

Biscayne Park

0.0572

Coral Gables

0.0572

Cutler Bay

0.0572

Doral

0.0572

El Portal

0.0610

Florida City

0.0592

Golden Beach

0.0262

Hialeah

0.0637

Hialeah Gardens

0.0572

Homestead

0.0592

Indian Creek Village

0.0120

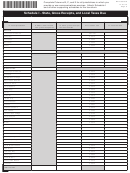

Key Biscayne

0.0572

Medley

0.0672

Miami

0.0572

Miami Beach

0.0572

Miami Gardens

0.0572

Miami Lakes

0.0572

Miami Shores Village

0.0622

Miami Springs

0.0572

North Bay Village

0.0540

North Miami

0.0572

North Miami Beach

0.0572

Opa-locka

0.0572

Palmetto Bay

0.0572

Pinecrest

0.0602

South Miami

0.0572

Sunny Isles Beach

0.0572

Surfside

0.0572

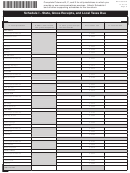

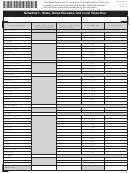

PAGE TOTAL

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24