Form Dr-700016 - Florida Communications Services Tax Return Page 16

ADVERTISEMENT

Direct-to-home satellite service providers must complete

DR-700016S

R. 01/15

Schedule II (and Schedule III, if needed) and attach to the

Page 16

tax return.

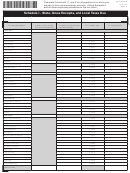

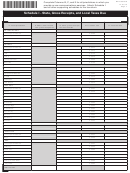

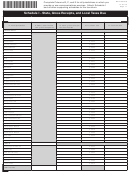

Schedule II - Direct-to-Home Satellite Services

Business name

Business partner number

C. Net Tax Due

A. Taxable Sales

B. Tax Rate

Enter this amount on Page 1, Line 4.

.1317

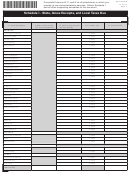

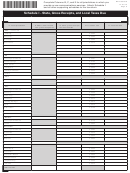

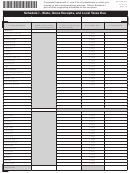

Schedule III - Direct-to-Home Satellite Services Adjustments

Business name

Reporting period

Business partner number

(Use last day of reporting period in MM/DD/YY format)

D. Adjustment

A. Change in

C. Collection

Amount

Reported Taxable

B. Rate

Allowance

E. Penalty

F. Interest

(Report credits in

Sales

Adjustment

parentheses)

G. TOTAL ADJUSTMENTS (Add Columns D, E, and F. Enter this amount on Page 1, Line 10)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24