Form Dr-700016 - Florida Communications Services Tax Return Page 13

ADVERTISEMENT

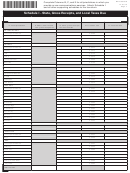

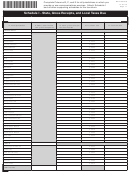

Complete Columns B, C, and E for all jurisdictions in which you

DR-700016S

R. 01/15

provide or use communications services. Attach Schedule I

Page 13

and all other supporting schedules to the tax return.

Schedule I - State, Gross Receipts, and Local Taxes Due

Business name

Business partner number

B. Taxable sales subject

C. Taxable sales subject

A. Local jurisdiction

to 6.65% state tax and

to 2.37% gross receipts

D. Local tax rate

E. Local tax due

.15% gross receipts tax

tax and local tax

PUTNAM

Unincorporated area

0.0244

Crescent City

0.0570

Interlachen

0.0582

Palatka

0.0582

Pomona Park

0.0582

Welaka

0.0582

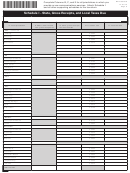

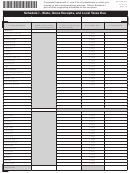

ST. JOHNS

Unincorporated area

0.0184

Hastings

0.0522

Marineland

0.0040

St. Augustine

0.0522

St. Augustine Beach

0.0522

ST. LUCIE

Unincorporated area

0.0214

Fort Pierce

0.0552

Port St. Lucie

0.0552

St. Lucie Village

0.0190

SANTA ROSA

Unincorporated area

0.0188

Gulf Breeze

0.0480

Jay

0.0160

Milton

0.0612

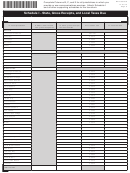

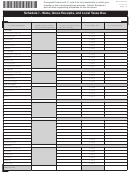

SARASOTA

Unincorporated area

0.0542

Longboat Key

0.0582

North Port

0.0632

Sarasota

0.0592

Venice

0.0582

SEMINOLE

Unincorporated area

0.0572

Altamonte Springs

0.0654

Casselberry

0.0602

Lake Mary

0.0582

Longwood

0.0612

Oviedo

0.0616

Sanford

0.0760

Winter Springs

0.0652

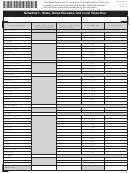

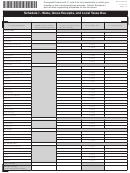

SUMTER

Unincorporated area

0.0234

Bushnell

0.0562

Center Hill

0.0572

Coleman

0.0572

Webster

0.0572

Wildwood

0.0572

PAGE TOTAL

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24