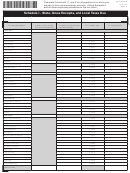

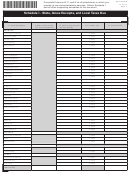

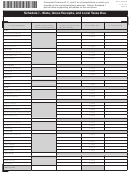

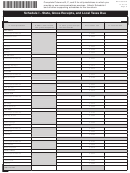

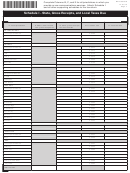

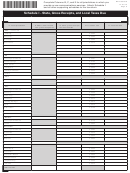

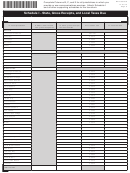

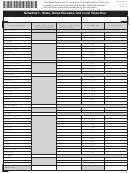

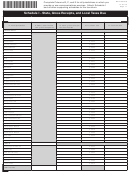

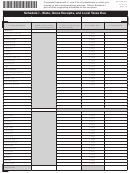

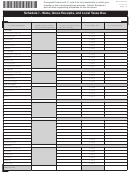

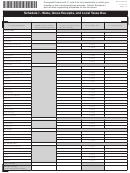

Form Dr-700016 - Florida Communications Services Tax Return Page 23

ADVERTISEMENT

DR-700016N

R. 01/15

Page 23

• If you are not using the DOR database, a database certified by DOR,

Example 3: $101,190.00 in taxable sales was originally reported

or a ZIP+4 database in compliance with s. 202.22, F.S., multiply

in Jurisdiction A (tax rate 1.10%) but should have been reported in

.0025 by the tax collected and/or accrued for sales being decreased

Jurisdiction B (tax rate 2.10%). Report the change (decrease) in taxable

in Column B.

sales ($101,190.00) in Jurisdiction A and the tax rate (1.10%) in the

appropriate columns. Report the decrease in parentheses. Report the

Column E - Adjustment amount. Subtract Column D from the tax

change (increase) in taxable sales ($101,190.00) in Jurisdiction B and the

collected and/or accrued for the sales reported in Column B, and enter

tax rate (2.10%) in the appropriate columns. The additional tax will be

the result.

due, along with penalty and interest.

Local Tax Calculation

If the rate of the correct jurisdiction is the same as or lower than the

original (incorrect) jurisdiction, the tax due amount reported should

Column F - Change in reported taxable sales. Enter the net change

be used to claim a credit in the original (incorrect) jurisdiction and this

in taxable sales for the appropriate jurisdiction(s). The net change

same tax due amount reported in the correct jurisdiction. Taxable sales

in taxable sales may include a reduction for eligible debts. Report

amounts should be calculated by dividing the tax amount by the tax rate

negative amounts in parentheses (amount).

for each affected jurisdiction. When tax is transferred to a jurisdiction

When changes in taxable sales are due to situsing or reporting errors

with a lower rate, calculated taxable sales will not match actual sales

and tax has not been refunded to the customer, use the following

to customers but will provide the information needed to correct the

calculations to determine the change in taxable sales.

allocation of tax reported.

If you are using the DOR database, a database certified by DOR, or

Example 4: $1,113.09 in local tax due was originally reported in

a ZIP+4 database in compliance with s. 202.22, F.S., adjustments to

Jurisdiction B (tax rate 2.10%), but should have been reported in

taxable sales should be made by reallocating the original local tax due

Jurisdiction A (tax rate 1.10%). Calculate the change (decrease)

amount reported in the wrong jurisdiction to the correct jurisdiction.

in taxable sales for Jurisdiction B by dividing the tax due originally

The tax should be reallocated regardless of the tax rate originally

reported in Jurisdiction B by its current tax rate. (EX: $1,113.09 divided

used or the tax rate of the correct jurisdiction. Taxable sales amounts

by .0210 = $53,004.29). Report the decrease in parentheses. Calculate

should be calculated by dividing the tax amount by the tax rate for each

the change (increase) in taxable sales to Jurisdiction A by dividing the

affected jurisdiction.

tax due originally reported in Jurisdiction B by the current tax rate for

Jurisdiction A. (EX: $1,113.09 divided by .0110 = $101,190.00).

Example 1: $1,113.09 in local tax due was originally reported in

Jurisdiction A (tax rate 1.10%), but should have been reported in

Column G - Rate. Enter the appropriate local rate for the applied

Jurisdiction B (tax rate 2.10%). Calculate the change (decrease) in

period you are adjusting.

taxable sales for Jurisdiction A by dividing the tax due originally reported

Column H - Collection allowance adjustment. Collection allowance

in Jurisdiction A by its current tax rate. (EX: $1,113.09 divided by .0110

adjustments are required for all transfers of tax between jurisdictions

= $101,190.00). Report the decrease in parentheses. Calculate the

and any transactions that result in a decrease in taxable sales for a

change (increase) in taxable sales to Jurisdiction B by dividing the tax due

prior applied period. If the original filing was not eligible for a collection

originally reported in Jurisdiction A by the current tax rate for Jurisdiction

allowance or if this schedule is being used to report only an increase

B. (EX: $1,113.09 divided by .0210 = $53,004.29).

in taxable sales for a prior applied period, this section does not apply.

Example 2: $1,113.09 in local tax due was originally reported in

Enter 0 (zero) in Column H.

Jurisdiction B (tax rate 2.10%), but should have been reported in

When a jurisdictional transfer results in a transfer to a jurisdiction

Jurisdiction A (tax rate 1.10%). Calculate the change (decrease)

with the same or higher tax rate, the collection allowance adjustment

in taxable sales for Jurisdiction B by dividing the tax due originally

must be capped at the amount claimed on the original return (i.e., no

reported in Jurisdiction B by its current tax rate. (EX: $1,113.09 divided

additional collection allowance will be granted on additional tax due as

by .0210 = $53,004.29). Report the decrease in parentheses. Calculate

a result of the transfer).

the change (increase) in taxable sales to Jurisdiction A by dividing the

tax due originally reported in Jurisdiction B by the current tax rate for

If Column F (Change in reported taxable sales) is a decrease (negative

Jurisdiction A. (EX: $1,113.09 divided by .0110 = $101,190.00).

number), the collection allowance must be recouped by one of the

following methods. The result should be entered as a positive number

If you are using a database that does not meet the requirements of

in Column H.

s. 202.22, F.S., you should identify the taxable sales and local tax due

amounts to be reallocated, the tax rates for the jurisdictions where the

• If you are using the DOR database, a database certified by DOR, or

tax was originally reported (incorrect jurisdiction), and where the tax

a ZIP+4 database in compliance with s. 202.22, F.S., multiply .0075

should be reported (correct jurisdiction).

by the tax collected and/or accrued for sales being decreased in

Column F.

If the correct jurisdiction has a higher tax rate, the original taxable sales

amount will be used to claim a credit in the incorrect jurisdiction. This

• If you are not using the DOR database, a database certified by DOR,

same taxable sales amount will be used in the correct jurisdiction to

or a ZIP+4 database in compliance with s. 202.22, F.S., multiply

calculate tax due. When multiplied by the tax rates, a higher local tax

.0025 by the tax collected and/or accrued for sales being decreased

due amount in the correct jurisdiction will result. Note that additional

in Column F.

local tax resulting from the transfer to a jurisdiction with a higher tax

Column I - Adjustment amount. Subtract Column H from the tax

rate will be due, along with penalty and interest. See “Penalty and

collected and/or accrued for the sales reported in Column F, and enter

Interest Calculation.”

the result. Report negative amounts in parentheses (amount).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24