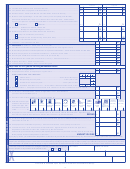

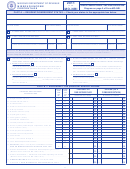

Form Mo-1040 - Booklet Missouri Individual Income Tax Long Form - 2011 Page 10

ADVERTISEMENT

Muscular Dystrophy Asso ci-

checks returned for insufficient or uncol-

American Lung Association of Missouri

a tion Fund (07) – Requests

lected funds. If you mail your payment after

Fund (04) – For more information,

your return is filed, attach your payment to

please contact: American Lung Asso-

for information and contributions may be

the Form MO-1040V found on page 40.

ciation Missouri Fund, 1118 Hampton Avenue,

made at any time directly to: Muscular

St. Louis, MO 63139-3196. (Min i mum irrevo-

Dystrophy Association, 8700 Indian Creek

Electronic Bank Draft (E-Check): By

cable contribution: $1, not to exceed $200)

Parkway, Suite 345, Overland Park, KS

entering your bank routing number,

66210; (816) 444-1554. (Min i mum irrevo-

check i ng account number, and your next

American Red Cross Trust

cable contribution: $1, not to exceed $200)

check number, you can pay on l ine at

Fund (15) – For more infor-

, or

mation please contact your local American

National Multiple Sclero sis

by calling (888) 929-0513. There will be a

Red Cross at or call

Society Fund (10) – Call

$.60 fee per filing period/ transaction to use

866-206-0256. (Minimum contribution: $1,

1-800-FIGHT MS or visit

this service.

or $2 if married filing combined)

our web site at

Credit Card: The Department

or contacting National Multiple Sclerosis

ALS Lou Gehrig’s Disease Fund

accepts MasterCard, Discover,

Society Fund, 1867 Lackland Hill Parkway,

(05) – Call 1-888-873-8539

Visa, and American Express. You

St. Louis, MO 63146. (Minimum irrevo-

for patient services in Eastern

can pay online at

cable contribution: $1, not to exceed $200)

Missouri and 1-800-878-2062 for patient

personal/individual/, or by calling (888)

services in Western Missouri. (Minimum

Puppy Protection Trust Fund

929-0513. The convenience fees listed

irrevocable contribution: $1, not to exceed

(17) - For more information,

below will be charged to your ac c ount for

$200)

please contact the Puppy

processing credit card payments:

Protection Trust Fund at

Arthritis Foundation Fund

Note: The convenience fees for these

or call (573) 751-3076. (Minimum contribu-

(09) – Call (314) 991-9333 or

transactions are paid to the third party

tion: $1, or $2 if married filing combined)

visit

vendor, not to the Missouri Department of

be made at any time directly to the Arthritis

l

46 — R

Revenue. By accessing this payment system,

ine

eFund

Foundation, 9433 Olive Blvd., Suite 100, St.

the user will be leaving Missouri’s web site

Subtract Lines 44 and 45 from Line 43 and

Louis, MO 63132. (Minimum irrevocable

and connecting to the web site of the third

enter on Line 46.

contribution: $1, not to exceed $200)

party vendor, which is a secure and confi-

Note: If you have any other liability due

dential web site.

Breast Cancer Awareness

the state of Missouri, such as child support

Fund (13) – All funds raised

payments, or a debt with the Internal

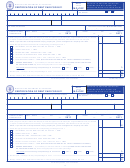

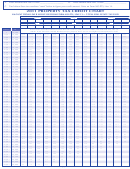

Amount of Tax Paid

Convenience Fee

are designated for the sole

Reve nue Service, your income tax refund

$0.00–$33.00

$1.00

purpose of providing breast cancer services.

may be applied to that liability in accor-

$33.01–$100.00

3.00%

For more information, please contact

dance with Section 143.781, RSMo. Your

$100.01–$250.00

2.95%

Winning Women Breast Cancer Awareness,

property tax credit may be applied to any

14248 F Manchester Road #318, St. Louis,

$250.01–$500.00

2.85%

property tax credit or individual income tax

MO 63011, or call (314) 920-0463.

$500.01–$750.00

2.85%

liability pursuant to Section 143.782, RSMo.

$750.01–$1,000.00

2.80%

Cervical

Cancer

Prevention

You will be notified if your refund is offset

Program (12) – For more infor-

against any debt(s).

$1,000.01–$1,500.00

2.75%

mation, contact the Missouri

$1,500.01–$2,000.00

2.70%

l

48 — u

ine

ndeRpAyment oF

Department of Health and Senior

$2,000.01 or more

2.60%

e

t

p

Services, Show Me Healthy Women Program,

stimAted

Ax

enAlty

P.O. Box 570, Jefferson City, MO 65102-

MAIL FORM MO-1040,

If the total payments and credits amount on

0570, call (573) 522-2845, or visit

ATTACHMENTS, AND PAYMENT

Line 39 less Line 36 or Line 42 less Line 36,

mo.gov/BreastCervCancer/. (No minimum

is less than 90 percent (66-2/3 percent for

(IF NECESSARY) TO:

contribution; irrevocable trust fund)

farmers) of the amount on Line 31, or if your

If you are due a refund or have no amount

Developmental Disabilities Waiting List

estimated tax payments were not paid timely,

due, mail your return and all required

Equity Trust Fund (16) – For more

you may owe a penalty. Complete Form

attach m ents to:

information please contact the Division

MO-2210, Underpayment of Estimated Tax

Department of Revenue

of Developmental Disabilities at www.

for Individuals, see pages 31-34. If you owe

P.O. Box 500

dmh.mo.gov/dd/ or call 1-800-207-9329.

a penalty, enter the pen a lty amount on Line

Jefferson City, MO 65106-0500.

(Minimum contribution: $1, or $2 if

48. If you have an overpayment on Line 43,

If you have a balance due, mail your return,

married filing combined)

the Department of Revenue will reduce your

overpayment by the amount of the penalty.

payment, and all re q uired attach m ents to:

Foster Care and Adoptive Recruitment and

Department of Revenue

Retention Fund (14) – For more informa-

l

49 — A

d

ine

mount

ue

P.O. Box 329

tion please contact: Missouri Children’s

Jefferson City, MO 65107-0329.

Payments must be postmarked by April 17,

Division, P.O. Box 88, Jefferson City,

2012, to avoid interest and late payment

2-D barcode returns, see page

2.

MO 65103-0088 or call (573)522-8024.

charges. The Department of Revenue offers

(Minimum contribution: $1, or $2 if married

s

R

ign

etuRn

several payment options.

filing combined)

You must sign Form MO-1040. Both spouses

Check or money order: Attach a check

March of Dimes Fund (08) –

must sign a combined return. If you use a

or money order (U.S. funds only), payable

Send requests for information

paid preparer, the preparer must also sign the

to Missouri Department of Revenue.

and contributions directly to

return. If you wish to authorize the Director

By submitting payment by check, you

the March of Dimes Fund, 11829 Dorsett

of Revenue to release information regarding

authorize the Department of Revenue to

Road, Maryland Heights, MO 63043.

your tax account to your preparer or any

process the check electronically upon

(Minimum irrevocable contribution: $1, not

member of your preparer’s firm, indicate by

receipt. Do not postdate. The Department

to exceed $200)

checking the “yes” box above the signature

of Revenue may electronically resubmit

line.

10

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44