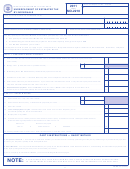

Form Mo-1040 - Booklet Missouri Individual Income Tax Long Form - 2011 Page 25

ADVERTISEMENT

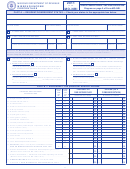

2011

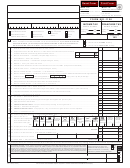

MISSOURI DEPARTMENT OF REVENUE

FORM

MO-HEA

HOME ENERGY AUDIT EXPENSE

NAME OF TAXPAYER

ADDRESS

CITY

STATE

ZIP

QUALIFICATIONS

Any taxpayer who paid an individual certified by the Department of Natural Resources to complete a home energy audit may deduct 100% of the costs incurred

for the audit and the implementation of any energy efficiency recommendations made by the auditor. The maximum yearly subtraction may not exceed $1,000,

for a single taxpayer or a married couple filing a combined return. The maximum total lifetime subtraction you may claim is $2,000. To qualify for the deduction,

you must have incurred expenses in the taxable year for which you are filing a claim, and the expenses incurred must not have been excluded from your

federal adjusted gross income or reimbursed through any other state or federal program.

INSTRUCTIONS - IN THE SPACES PROVIDED BELOW:

• Report the name of the auditor who conducted the audit

• Enter the total amount paid to implement the energy efficiency recommendations on Line B

• Report the auditor’s certification number

• Enter the total amount paid for the audit and any implemented recommendations on Line C

• Attach applicable receipts

• Summarize each of the auditor’s recommendations

• Attach completed MO-HEA and receipts to Form MO-1040

• Enter the amount paid for the audit on Line A

NAME OF AUDITOR

AUDITOR CERTIFICATION NUMBER

SUMMARY OF RECOMMENDATIONS

1.

2.

3.

4.

5.

00

A.

A. Amount paid for audit ........................................................................................................................................

00

B. Amount paid to implement recommendations .................................................................................................

B.

C. Total Paid - Add Lines A and B and enter here. Enter Line C or $1,000, whichever is less, on Line 13 of Form

00

C.

MO-A. If you are filing a combined return, you may split the amount reported on Line 13 between both taxpayers .....

MO-HEA (12-2011)

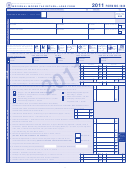

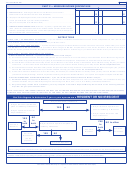

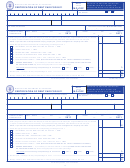

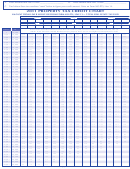

2011 TAX TABLE

If Missouri taxable income from Form MO‑1040, Line 24, is less than $9,000, use the table to figure tax;

if more than $9,000, use worksheet below or use the online tax calculator at

If Line 24 is

If Line 24 is

If Line 24 is

If Line 24 is

If Line 24 is

If Line 24 is

But

But

But

But

But

But

At

less

Your

At

less

Your

At

less

Your

At

less

Your

At

less

Your

At

less

Your

least

than

tax is

least

than

tax is

least

than

tax is

least

than

tax is

least

than

tax is

least

than

tax is

0

100

$ 0

1,500

1,600

$ 26

3,000

3,100

$ 62

4,500

4,600

$ 109

6,000

6,100

$ 167

7,500

7,600

$ 238

100

200

2

1,600

1,700

28

3,100

3,200

65

4,600

4,700

113

6,100

6,200

172

7,600

7,700

243

200

300

4

1,700

1,800

30

3,200

3,300

68

4,700

4,800

116

6,200

6,300

176

7,700

7,800

248

300

400

5

1,800

1,900

32

3,300

3,400

71

4,800

4,900

120

6,300

6,400

181

7,800

7,900

253

400

500

7

1,900

2,000

34

3,400

3,500

74

4,900

5,000

123

6,400

6,500

185

7,900

8,000

258

500

600

8

2,000

2,100

36

3,500

3,600

77

5,000

5,100

127

6,500

6,600

190

8,000

8,100

263

600

700

10

2,100

2,200

39

3,600

3,700

80

5,100

5,200

131

6,600

6,700

194

8,100

8,200

268

700

800

11

2,200

2,300

41

3,700

3,800

83

5,200

5,300

135

6,700

6,800

199

8,200

8,300

274

800

900

13

2,300

2,400

44

3,800

3,900

86

5,300

5,400

139

6,800

6,900

203

8,300

8,400

279

900

1,000

14

2,400

2,500

46

3,900

4,000

89

5,400

5,500

143

6,900

7,000

208

8,400

8,500

285

1,000

1,100

16

2,500

2,600

49

4,000

4,100

92

5,500

5,600

147

7,000

7,100

213

8,500

8,600

290

1,100

1,200

18

2,600

2,700

51

4,100

4,200

95

5,600

5,700

151

7,100

7,200

218

8,600

8,700

296

1,200

1,300

20

2,700

2,800

54

4,200

4,300

99

5,700

5,800

155

7,200

7,300

223

8,700

8,800

301

1,300

1,400

22

2,800

2,900

56

4,300

4,400

102

5,800

5,900

159

7,300

7,400

228

8,800

8,900

307

1,400

1,500

24

2,900

3,000

59

4,400

4,500

106

5,900

6,000

163

7,400

7,500

233

8,900

9,000

312

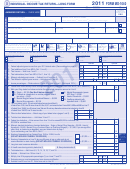

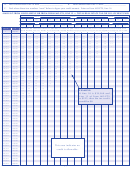

9,000

315

Yourself

Spouse

Example

If more than $9,000,

$ _______________

$ _______________

Missouri taxable income (Line 24) ...........

$ 12,000

tax is $315 PLUS 6% of

excess over $9,000.

Subtract $9,000 ....................................

– $

9,000

– $

9,000

– $ 9,000

Round to nearest whole

= $ _______________

= $ _______________

Difference .............................................

= $ 3,000

dollar and enter on Form

x

6%

x

6%

Multiply by 6%.......................................

x

6%

MO-1040, Page 2, Line 25.

Tax on income over $9,000 ..................

= $ _______________

= $ _______________

= $

180

+ $

315

+ $

315

Add $315 (tax on first $9,000) ..............

+ $

315

TOTAL MISSOURI TAX .......................

= $ _______________

= $ _______________

= $

495

A separate tax must be computed for you and your spouse.

25

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44