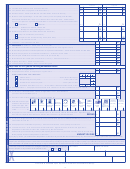

Form Mo-1040 - Booklet Missouri Individual Income Tax Long Form - 2011 Page 7

ADVERTISEMENT

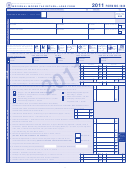

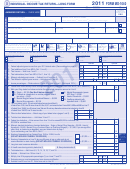

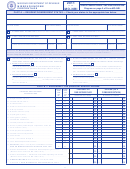

FIGURE YOUR

l

11 — o

F

t

Itemized Deductions: If you itemized on

ine

theR

edeRAl

Ax

your federal return, you may want to itemize

TAXABLE INCOME

Enter the total amount of Lines 45, 47, 58, any

on your Missouri return or take the standard

first time home buyer credit repayment on

deduction, whichever results in a higher

l

8 — p

s

ine

ension And

ociAl

Line 59b, and any recapture taxes included

deduction. If you were required to itemize

s

/s

s

on Line 61 from Federal Form 1040. Enter

ecuRity

ociAl

ecuRity

on your federal return, you must itemize on

d

/m

e

the amount of alternative minimum tax

your Missouri return. To figure your item-

isAbility

ilitARy

xemption

included on Line 28 of Federal Form 1040A.

ized deductions, complete the Form MO-A,

If you or your spouse received a public,

For amended returns enter the other taxes

Part 2. Attach a copy of your federal return

private, or military pension, social security

(pages 1 and 2) and Federal Schedule A.

re p orted on Line 9 of Federal Form 1040X

or social security disability, complete Form

except: do not include self-employment tax,

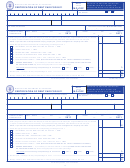

l

15

16 —

MO-A, Part 3. Enter the amount from Form

ines

And

FICA tax, or railroad retirement tax on this

t

n

d

MO-A, Part 3, Total Exemption on MO-1040,

otAl

umbeR oF

ependents

line. Attach a copy of your federal return

Line 8. Attach a copy of your federal return

Do not include yourself or your spouse as

(pages 1 and 2). Attach a copy of Federal

(pages 1 and 2), Forms 1099-R, W-2P, and

dependents.

Forms 4255, 8611, or 8828 if claiming recap-

SSA-1099. Failure to attach these copies will

Line 15 - Multiply by $1,200 the total

ture taxes.

result in the disallowance of your exemption.

number of dependents you claimed on

l

13 — F

i

l

9 — F

s

ine

edeRAl

ncome

Line 6c of your federal return.

ine

iling

tAtus And

t

d

e

A

Ax

eduction

Line 16 - Multiply by $1,000 the total

xemption

mount

number of dependents you claimed on

If you checked Box A, B, D, E, F, or G on

Check the box applicable to your filing status.

Line 15 that were age 65 or older by

Line 9, your federal tax deduction may not

You must use the same filing status as on your

the last day of the taxable year. Do not

exceed $5,000. If you checked Box C on

Federal Form 1040 with two exceptions:

include dependents that receive state

Line 9, your federal tax deduction may not

1. Box B must be checked if you are claimed

fund ing or Medicaid. Attach a copy of

exceed $10,000.

as a dependent on another person’s federal

your federal return (pages 1 and 2).

tax return and you checked either box on

l

14 — s

ine

tAndARd oR

l

17 — l

-

c

ine

ong

teRm

ARe

Federal Form 1040EZ, Line 5; or you were

i

d

temized

eductions

i

d

not allowed to check Box 6a on Federal

nsuRAnce

eduction

Standard Deductions: If you claimed the

Forms 1040 or 1040A. If you checked Box

If you paid premiums for qualified long-term

standard deduction on your federal return,

B, enter “0”.

care insurance in 2011, you may be eligible

enter the standard deduction amount for

2. Box E may be checked only if all of the

for a deduction on your Missouri income tax

your filing status. The amounts are listed

return. Qualified long-term care insurance

following apply: a) you checked Box 3

on Form MO-1040, Line 14.

is defined as insurance coverage for at least

(married filing separate return) on your

12 months for long-term care expenses

Federal Form 1040 or 1040A; b) your

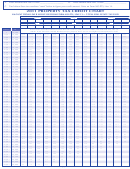

Use the chart below to determine your

should such care become necessary because

spouse had no income and is not required

standard deduction if you or your spouse

of a chronic health condition or physical

to file a federal return; and c) your spouse

marked any of the boxes for: 65 or older,

disability, including cognitive impairment

was claimed as an exemption on your

blind or claimed as a dependent.

or the loss of functional capacity, thus

federal return and was not a dependent of

rendering an individual unable to care for

someone else. Only one box may be

Federal Form

Line Numbers

themselves without the help of another

checked on Line 9, Boxes A through G.

person. Complete the worksheet below

1040

L ine 40

Enter on Line 9 the amount of exemption

only if you paid premiums for a qualified

1040A

L ine 24

claimed for your filing status on Boxes A

long-term care insurance policy; and the

1040EZ

*See following note

through G. The amounts are listed on Form

policy is for at least 12 months coverage.

MO-1040. Attach a copy of your federal return.

Note: You can not claim a deduction for

1040X

L ine 2

amounts paid toward death benefits or

l

10 — t

F

F

ine

Ax

Rom

edeRAl

extended riders.

*Note: If you filed a Federal Form 1040EZ,

R

etuRn

l

18 — h

c

s

and checked one or both boxes on Line 5,

ine

eAlth

ARe

hARing

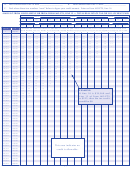

Use the chart below to locate your tax on

refer to the Federal Standard Deduction

m

/n

j

d

inistRy

eW

obs

eduction

your federal return.

Worksheet for Dependents. If you did not

If you made contributions to a qualifying

Do not enter your federal income tax

check either box on Federal Form 1040EZ,

health care sharing ministry, enter the

withheld as shown on your Forms W-2 or

Line 5, enter $5,800 if single or $11,600 if

amounts you paid in 2011 on Line 18A. Do

federal return.

married.

not include amounts excluded from your

If you have an earned income credit, you

federal taxable income.

must subtract the credit from the tax on your

federal return. If a negative amount is calcu-

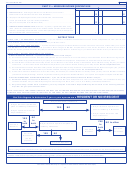

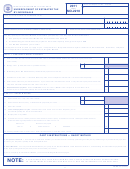

W

l

-t

c

i

d

oRksheet FoR

ong

eRm

ARe

nsuRAnce

eduction

lated, enter “0”. If you used a method other

than the federal tax table to determine your

A. E nter the amount paid for qualified long-term care insurance policy. . ..... A) $___________

federal tax, attach the appropriate schedule.

I f you itemized on your federal return and your federal itemized

deductions included medical expenses, go to Line B. If not, skip to H.

Federal

B. E nter the amount from Federal Schedule A, Line 4. ............................ B) $___________

Form

Line Numbers

C. E nter the amount from Federal Schedule A, Line 1. ............................ C) $___________

1040

Line 55 minus Lines 45, 64a, 66,

D. E nter the amount of qualified long-term care included on Line C. ..... D) $___________

67, and amounts from Forms 8801,

E. S ubtract Line D from Line C. .............................................................. E) $___________

8839 and 8885 on Line 71.

F. S ubtract Line E from Line B. If amount is less than zero, enter “0”...... F) $___________

1040A

Line 35 minus Lines 38a, 40, and any

G . S ubtract Line F from Line A. .............................................................. G) $___________

alternative minimum tax included on

Line 28.

H. E nter Line G (or Line A if you did not have to complete Lines B through G) on Form

MO-1040, Line 17

1040EZ Line 10 minus Line 8a.

Attach a copy of your Federal Form 1040 (pages 1 and 2) and Federal Schedule A

1040X

Line 8 minus Lines 13 and 14, except

(if you itemized your deductions).

amounts from Forms 2439 and 4136.

7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44