Form Mo-1040 - Booklet Missouri Individual Income Tax Long Form - 2011 Page 22

ADVERTISEMENT

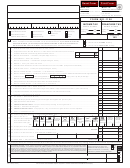

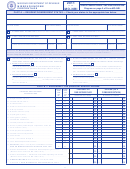

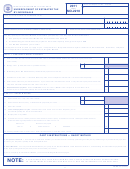

INFORMATION TO COMPLETE FORM MO-CR

Complete this form if you are a Missouri resident, resident estate, or resident trust with income from another state(s).

A part-year resident may elect to use this form to determine his/her tax as if he/she were a resident for the entire taxable year.

If you pay tax to more than one state, you must complete a separate Form MO-CR for each state.

Before you begin:

• Complete your Missouri return, Form MO-1040 (Lines 1–25).

• Complete the other state’s return(s) to determine the amount of income tax you paid to the other state(s).

Line 1 — Enter the amount from Form MO‑1040, Line 5Y and 5S.

Line 8 — Divide Line 7 by Line 1. If greater than 100 percent, enter 100 percent.

Round whole percent, such as 91 percent instead of 90.5 percent. If percentage

Line 2 — Enter the amount from Form MO‑1040, Line 25Y and 25S.

is less than 0.5 percent, use exact percentage. Enter percentage on Line 8.

Lines 3 and 4 — Enter the total amount of wages, commissions, and other

Line 9 — Multiply Line 2 by percentage on Line 8. Enter amount on Line 9.

income you or your spouse received from the other state(s), as reported on the

Line 10 — Enter your income tax liability as reported on the other state(s)

other state(s) return.

income tax return. This is not income tax withheld. The income tax entered

Line 5 — Add Lines 3 and 4; enter the total on Line 5.

must be reduced by all credits, except withholding and estimated tax. If both you

and your spouse paid income tax to the other state(s), each must claim his/her

Line 6 — Enter any federal adjustments from:

own portion of the tax liability.

Federal Form 1040.............Line 36

Federal Form 1040A ..........Line 20

Line 11 — Enter the smaller amount from Form MO‑CR, Line 9 or Line 10. This

is your Missouri resident credit. Enter the amount on Form MO‑1040, Lines 26Y

Line 7 — Subtract Line 6 from Line 5. Enter the difference on Line 7.

and 26S. (If you have multiple credits, add the amounts on Line 11 from each

MO‑CR). Your total credit cannot exceed the tax paid or the percent of tax due

Missouri on that part of your income.

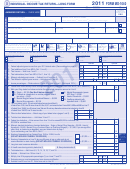

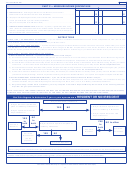

Two Letter Abbreviations for States

AL—Alabama

CT—Connecticut

HI—Hawaii

KY—Kentucky

MN—Minnesota

NJ—New Jersey

OK—Oklahoma

TN—Tennessee

WV—West Virginia

AK—Alaska

DC— District of

ID—Idaho

LA—Louisiana

MS—Mississippi

NM—New Mexico

OR—Oregon

TX—Texas

WI—Wisconsin

AZ—Arizona

Columbia

IL—Illinois

ME—Maine

MT—Montana

NY—New York

PA—Pennsylvania

UT—Utah

WY—Wyoming

AR—Arkansas

DE—Delaware

IN—Indiana

MD—Maryland

NE—Nebraska

NC—North Carolina

RI—Rhode Island

VT—Vermont

CA—California

FL—Florida

IA—Iowa

MA—Massachusetts

NV—Nevada

ND—North Dakota

SC—South Carolina

VA—Virginia

CO—Colorado

GA—Georgia

KS—Kansas

MI—Michigan

NH—New Hampshire

OH—Ohio

SD—South Dakota

WA—Washington

This form is available upon request in alternative accessible format(s).

MO 860-1095 (12-2011)

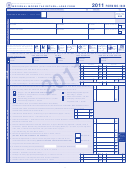

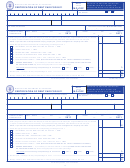

INFORMATION TO COMPLETE FORM MO-CR

Complete this form if you are a Missouri resident, resident estate, or resident trust with income from another state(s).

A part-year resident may elect to use this form to determine his/her tax as if he/she were a resident for the entire taxable year.

If you pay tax to more than one state, you must complete a separate Form MO-CR for each state.

Before you begin:

• Complete your Missouri return, Form MO-1040 (Lines 1–25).

• Complete the other state’s return(s) to determine the amount of income tax you paid to the other state(s).

Line 1 — Enter the amount from Form MO‑1040, Line 5Y and 5S.

Line 8 — Divide Line 7 by Line 1. If greater than 100 percent, enter 100 percent.

Round whole percent, such as 91 percent instead of 90.5 percent. If percentage

Line 2 — Enter the amount from Form MO‑1040, Line 25Y and 25S.

is less than 0.5 percent, use exact percentage. Enter percentage on Line 8.

Lines 3 and 4 — Enter the total amount of wages, commissions, and other

Line 9 — Multiply Line 2 by percentage on Line 8. Enter amount on Line 9.

income you or your spouse received from the other state(s), as reported on the

Line 10 — Enter your income tax liability as reported on the other state(s)

other state(s) return.

income tax return. This is not income tax withheld. The income tax entered

Line 5 — Add Lines 3 and 4; enter the total on Line 5.

must be reduced by all credits, except withholding and estimated tax. If both you

and your spouse paid income tax to the other state(s), each must claim his/her

Line 6 — Enter any federal adjustments from:

own portion of the tax liability.

Federal Form 1040.............Line 36

Line 11 — Enter the smaller amount from Form MO‑CR, Line 9 or Line 10. This

Federal Form 1040A ..........Line 20

is your Missouri resident credit. Enter the amount on Form MO‑1040, Lines 26Y

Line 7 — Subtract Line 6 from Line 5. Enter the difference on Line 7.

and 26S. (If you have multiple credits, add the amounts on Line 11 from each

MO‑CR). Your total credit cannot exceed the tax paid or the percent of tax due

Missouri on that part of your income.

Two Letter Abbreviations for States

AL—Alabama

CT—Connecticut

HI—Hawaii

KY—Kentucky

MN—Minnesota

NJ—New Jersey

OK—Oklahoma

TN—Tennessee

WV—West Virginia

AK—Alaska

DC— District of

ID—Idaho

LA—Louisiana

MS—Mississippi

NM—New Mexico

OR—Oregon

TX—Texas

WI—Wisconsin

AZ—Arizona

Columbia

IL—Illinois

ME—Maine

MT—Montana

NY—New York

PA—Pennsylvania

UT—Utah

WY—Wyoming

AR—Arkansas

DE—Delaware

IN—Indiana

MD—Maryland

NE—Nebraska

NC—North Carolina

RI—Rhode Island

VT—Vermont

CA—California

FL—Florida

IA—Iowa

MA—Massachusetts

NV—Nevada

ND—North Dakota

SC—South Carolina

VA—Virginia

CO—Colorado

GA—Georgia

KS—Kansas

MI—Michigan

NH—New Hampshire

OH—Ohio

SD—South Dakota

WA—Washington

This form is available upon request in alternative accessible format(s).

MO 860-1095 (12-2011)

22

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44