Form Mo-1040 - Booklet Missouri Individual Income Tax Long Form - 2011 Page 9

ADVERTISEMENT

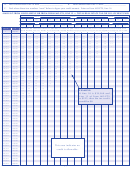

Indicate the Reason for

Elderly Home Delivered Meals

and assessment program/project. For more

Trust Fund – The Elderly Home

information please contact: Cindy Heislen at

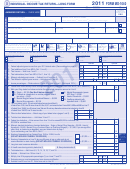

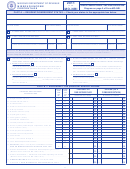

Amending Your Return:

Delivered Meals Trust Fund supports

(573) 522-2627, eelext@dese.mo.gov.

Check the box relating to why you are filing

the home delivered meals program for

Organ Donor Program Fund –

an amended return.

Missouri’s home-bound senior citizens,

Contributions support organ and

helping them to continue to live indepen-

• B ox A—Mark Box A (federal audit) if

tissue donation education and registry

you have knowledge or have received a

dently in their homes. The need for home

operation. For more information, please contact:

notice that your federal return you previ-

delivered meals increases yearly as persons

Missouri Department of Health and Senior

ously filed was incorrect, or if the Internal

are living longer and may need assistance.

Services, Organ and Tissue Donor Program,

Revenue Service adjusted your original

For more information please contact: http://

P.O. Box 570, Jefferson City, MO 65102-0570,

return. You must attach a copy of your

health.mo.gov/seniors/aaa/index.php.

or call 888-497-4564. (Minimum contribution:

amended federal return or a copy of your

(Minimum contribution $2, or $4 if married

revenue agent’s report. Enter the month,

$2, or $4 if married filing combined)

filing combined)

day, and year your audit was finalized.

A

F

dditionAl

unds

Missouri National Guard Trust

• B ox B—Mark Box B if you have a net oper-

Fund – The Missouri National Guard

ating loss carryback on your amended

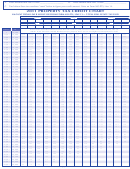

If you choose to give to additional funds,

Trust Fund expands the capability to

return. Indicate the year your loss occurred.

enter the two-digit additional fund code

provide/coordinate Military Funeral Honors

• B ox C—Mark Box C if you have an invest-

in the spaces provided on Line 45. If you

Ceremonies for veterans of Missouri and

ment tax credit carryback on your amended

want to give to more than two additional

veterans buried in Missouri who have served

return. Indicate the year your credit occurred.

funds, please submit a contribution directly

their country in an honorable manner.

• B ox D—Mark Box D if you are filing an

to the fund. For additional information, see

Contributions may be made at any time

amended Missouri return as a result of

directly to Missouri National Guard Trust

filing an amended federal return. Enter

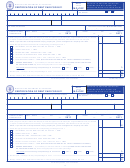

Donations received from the following funds

Fund, ATTN: JFMO-J1/SSH, 2302 Militia

the month, day, and year you filed your

are designated specifically for Missouri residents.

Drive, Jefferson City, MO 65101-1203 or

amended federal return.

Funds

Codes

call (573)638-9663. (Minimum contribu-

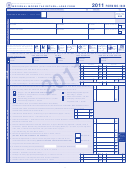

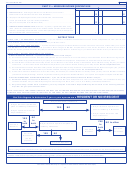

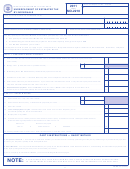

FIGURE YOUR REFUND

American Cancer Society Heartland

tion: $2, or $4 if married filing combined)

Division, Inc., Fund ..................................01

OR AMOUNT DUE

Workers’ Memorial Fund – This fund has

American Diabetes Association

been established to create a perma-

Gateway Area Fund ............................02

l

43 — o

Workers

ine

veRpAyment

nent memorial for all workers who

American Heart Association Fund ............03

If Line 39 is larger than Line 31, or on an

suffered a job related death or injuries

American Lung Association of

amended return, Line 42 is larger than Line

that resulted in a permanent disability while on

Missouri Fund .....................................04

31, enter the difference (overpayment) on

the job in Missouri. Requests for information

American Red Cross Trust Fund ................15

Line 43. All or a portion of an overpayment

and contributions may be made at any time

Amyotrophic Lateral Sclerosis (ALS—Lou

can be refunded to you.

to: Workers’ Memorial Fund, ATTN: Office of

Gehrig’s Disease) Fund ........................05

l

44 — A

o

Administration, 301 W. High St., Room 570,

ine

pply

veRpAyment to

Arthritis Foundation Fund .........................09

Jefferson City, MO 65101. (Minimum contri-

n

y

’

t

Breast Cancer Awareness Fund .................13

ext

eAR

s

Axes

bution: $1, or $2 if married filing combined)

Cervical Cancer Fund ...............................12

You may apply any portion of your refund

Developmental Disabilities Waiting List

to next year’s taxes.

Childhood Lead Testing Fund -

Equity Trust Fund ................................16

LEAD

Activities supported by this fund ensure

l

45 — t

F

ine

Rust

unds

Foster Care and Adoptive Recruitment and

that Missouri children at risk for lead

You may donate part or all of your

Retention Fund ....................................14

poisoning are tested and receive appropriate

overpaid amount or contribute additional

March of Dimes Fund ...............................08

follow-up activities to protect their health and

pay m ents to any of the ten trust funds

Muscular Dystrophy Association Fund .....07

well being from the harmful effects of lead.

listed on Form MO-1040 or any two

National Multiple Sclerosis Society Fund ....10

For more information please contact the

additional trust funds.

Puppy Protection Trust Fund ....................17

Missouri State Public Health Laboratory at

(573) 751-3334, or email labweb1@health.

Children’s Trust Fund – Children’s

American Cancer Society Heartland

mo.gov. (Min imum contribution: $1, or $2 if

Trust Fund, Missouri’s Foundation

Division, Inc., Fund (01) – For

married filing combined)

for Child Abuse Prevention, is

more information anytime, call

a non-profit organization dedicated to

toll free 1-800-ACS-2345 or visit www.

General Revenue Fund – Requests

the vision of children free to grow and

G

. Donations can be sent directly

eneral

for information and contributions

R

evenue

reach their full potential in a nurturing

to the American Cancer Society at 1100

may be made at any time directly to

and healthy environment free from child

Pen n sylvania Avenue, Kansas City, MO

General Revenue Fund, ATTN: Department

abuse and neglect. For more information

64105. (Minimum irrevocable contribution:

of Revenue, P.O. Box 3022, Jefferson City,

please contact the Children’s Trust Fund

$1, not to exceed $200)

MO 65105-3022. (Minimum contribution:

or call 888-826-5437.

$1, or $2 if married filing combined)

American Diabetes Asso ci-

(Minimum contribution: $2, or $4 if married

a tion Gateway Area Fund

filing combined)

Missouri Military Family Relief

(02) – Requests for infor-

Fund – For more information, please

Veterans Trust Fund – The Missouri

mation may be made by calling (314)

contact: Missouri Military Family

Veterans Commission’s Veterans

822-5490 or contacting Gateway Area

Relief Fund, 2302 Militia Drive, ATTN:

Trust Fund is a means by which

Diabetes Association Fund, 425 South

JFMO-J1/SS, Jefferson City, MO 65201-1203.

individuals and corporations

Woods Mill Road #110, Town and Country,

(Minimum contribution: $1, or $2 if married

may donate money to expand and improve

MO 63017. (Minimum irrevocable contribu-

filing combined)

services to veterans in Missouri. Contri-

tion: $1, not to exceed $200)

butions may be made at any time directly

After-School Retreat Reading and

American Heart Association Fund

to: Veterans Trust Fund c/o The Missouri

Assessment Grant Program Fund –

(03) – For more information, please

Veterans Commission, P.O. Drawer 147,

Contributions can be made to the Department

contact: American Heart Association,

Jefferson City, MO 65102-0147 or call

of Elementary and Secondary Education

460 N. Lindbergh Blvd., St. Louis, MO

(573)751-3779. (Minimum contribution: $2,

to assist Missouri public schools or charter

63141-7808, or call (314) 392-5600.

or $4 if married filing combined)

schools in developing an after-school reading

(Minimum irrevocable contribution: $1, not

to exceed $200)

9

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

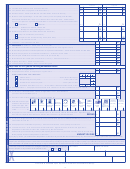

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44