Form Mo-1040 - Booklet Missouri Individual Income Tax Long Form - 2011 Page 36

ADVERTISEMENT

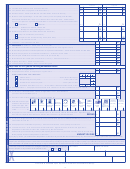

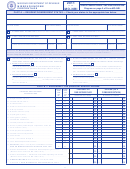

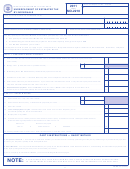

FORM MO-PTS

amounts here. If you are not eligible for the

Social Security Disability Benefits on Line

social security or social security disability

5. However, if you are married filing a

exemption, enter a $0 on Line 11.

combined return, one spouse may enter an

INFORMATION TO COMPLETE

amount on Line 4 and the other spouse may

PRIVATE PENSION CALCULATION

FORM MO-PTS

enter an amount on Line 5.

l

2 — t

s

ine

AxAble

ociAl

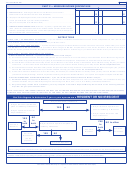

If you qualify for the Property Tax Credit you

MILITARY PENSION CALCULATION

s

b

ecuRity

eneFits

must attach your Form MO-PTS to your

A military pension is a pension received for

Form MO-1040 and mail to: Missouri

Include the taxable 2011 social security

your service in a branch of the armed services

Department of Revenue, P.O. Box 2800,

benefits. This information can be found on:

of the United States, including the Missouri

Jefferson City, MO 65105-2800.

• Federal Form 1040A—Line 14b

Army Reserve and Missouri National Guard.

• Federal Form 1040—Line 20b

Important: You must complete Form

You must reduce your military pension

MO-1040, Line 1 through Line 37, before

l

6 — t

p

ine

AxAble

ension

exemption by any portion of your military

you complete Form MO-PTS.

pension that is included in the calculation of

Include the taxable 2011 pension received

Note: If your filing status on Form MO-1040

your public pension exemption. Therefore, if

from private sources for each spouse. This

is married filing combined, but you and your

you qualify for the public pension, make sure

information can be found on:

spouse lived at different addresses the entire

you complete the Public Pension Calculation

• F ederal Form 1040A— Lines 11b and 12b

year, you may file a separate Form MO-PTC.

(Section A) before you calculate your military

• Federal Form 1040—Lines 15b and 16b

Do not include spouse name or social security

pension exemption.

Do not include any payments from public

number if you marked married filing separate.

pensions, social security benefits, or

l

1 — t

m

ine

AxAble

ilitARy

(Exam p le: One spouse lives in a nursing home

railroad retirement payments on this line.

R

b

etiRement

eneFits

or residential care facility while the other

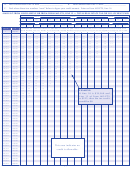

SOCIAL SECURITY OR SOCIAL

spouse remains in the home the entire year.)

Include your total military retirement bene-

SECURITY DISABILITY

If filing a separate Form MO-PTC, you cannot

fits reported on federal Form 1040A, Line

CALCULATION

take the $2,000 or $4,000 deduction on Line

12b or federal Form 1040, Line 16b. If you

7 and you cannot calculate your Property Tax

l

4 — t

s

ine

AxAble

ociAl

are filing a combined return and both spouses

Credit on the Form MO-PTS.

s

b

had military retirement, combine those amounts

ecuRity

eneFits

q

on Line 1.

uAliFicAtions

To take the social security exemption, you

l

2 — t

p

p

must be age 62 or older. An individual that

Check the applicable box to indicate under

ine

AxAble

ublic

ension

receives social security retirement benefits,

which qualification you are filing the Form

Include your total retirement benefits from

partial benefits at age 62, full benefits at

MO-PTS. You must check a qualification

public sources (including military) reported

age 65 or older, or a disabled individual

box to be eligible for the credit. Check only

on federal Form 1040A, Line 12b or federal

receiving social security disability income

one box. Attach the appropriate documen-

Form 1040, Line 16b. If you are filing

(SSDI), who reaches full retirement age

tation to verify your qualification. (The

a combined return and both spouses had

during the taxable year and receives retire-

required documentation is listed behind

retirement benefits from public sources,

ment benefits should include on Line 4, the

each qualification on Form MO-PTS.)

combine those amounts on Line 2.

amount of federal taxable benefits, which

l

4 — m

b

can be found on:

ine

ilitARy

eneFits

HELPFUL HINTS

• Federal Form 1040A—Line 14b

i

p

p

ncluded in

ublic

ension

If you are legally married and living together,

• Federal Form 1040—Line 20b

e

xemption

you must file married filing combined and

Taxable social security benefits must

include all household income.

Multiply the percentage calculated on Line 3

be allocated by each spouse’s share of

Please use the social security number of the

the benefits received for the year. To

by the total public pension amount reported

person filing the claim.

determine each spouse’s portion of the

on Line 14 of Section A. If you did not claim a

taxable social security on Line 4, complete

public pension, enter $0.

l

2 — s

s

b

ine

ociAl

ecuRity

eneFits

worksheet for Lines 4 and 5 (below).

l

6 —t

m

p

ine

otAl

ilitARy

ension

Enter the amount of nontaxable social

l

5 — t

s

s

ine

AxAble

ociAl

ecuRity

The maximum military exemption you may

security benefits before any deductions and

d

b

isAbility

eneFits

claim in 2011 is equal to 30 percent of your

the amount of social security equivalent

A disabled individual, receiving social

military pension. Multiply the amount on

railroad re t ire m ent benefits. See the fol l ow-

security disability income (SSDI) for the

Line 5 by 30 percent.

ing to deter m ine nontaxable benefits:

entire taxable year should enter on Line

• Federal Form 1040, Line 20a less Line 20b

5, the amount of federal taxable benefits,

• Federal Form 1040A, Line 14a less Line 14b

which can be found on:

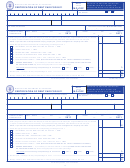

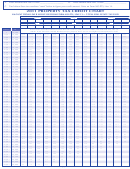

WORKSHEET FOR LINES 4 AND 5

• F ederal Form 1040A— Line 14b

• F ederal Form 1040—Line 20b

1. Total social security - Enter amount from:

1 __________

Taxable social security disability benefits

• Federal Form 1040A, Line 14a

must be allocated by each spouse’s share

of the benefits received for the year. To

• Federal Form 1040, Line 20a

determine each spouse’s portion of the

Yourself

Spouse

taxable social security disability on Line

2. Enter each spouse’s portion of the total social security

2Y________ 2S________

5, complete worksheet for Lines 4 and 5

3. Divide Line 2Y and 2S by Line 1

3Y______% 3S______%

(below).

4. Taxable social security - Enter amount from:

4 __________

Note: A taxpayer filing single, head of

household, qualifying widower, or married

• Federal Form 1040A, Line 14b

filing separate may not enter amounts

• Federal Form 1040, Line 20b

on both Line 4, Taxable Social Security

5. Multiply Line 4 by percentages on 3Y and 3S and enter

5Y________ 5S________

Benefits, and Line 5, Taxable Social

Security Disability Benefits. Report only

amounts here and on Lines 4 or 5 of Part 3 of the MO-A, Section C

Social Security Benefits on Line 4 and

36

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44