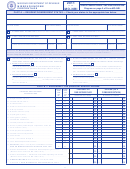

Form Mo-1040 - Booklet Missouri Individual Income Tax Long Form - 2011 Page 21

ADVERTISEMENT

2011

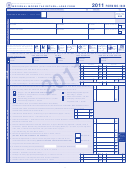

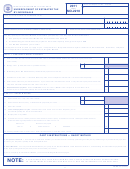

Attachment Sequence No. 1040-03

MISSOURI DEPARTMENT OF REVENUE

CREDIT FOR INCOME TAXES PAID TO

FORM

MO-CR

OTHER STATES

OR POLITICAL SUBDIVISIONS

Complete this form if you or your spouse have income from another state or

• A ttach a copy of all income tax returns for each

state or political subdivision.

political subdivision. If you had multiple credits, complete a separate form for

each state or political subdivision.

• Attach Form MO-CR to Form MO-1040.

YOUR NAME

YOUR SOCIAL SECURITY NO.

YOUR SPOUSE’S NAME

SPOUSE’S SOCIAL SECURITY NO.

YOURSELF

SPOUSE

1. Claimant’s total adjusted gross income

00

00

(Form MO‑1040, Line 5Y and Line 5S) ......................................................................................... 1

1

2. Claimant’s Missouri income tax

00

00

(Form MO‑1040, Line 25Y and Line 25S) .................................................................................... 2

2

USE TWO LETTER ABBREVIATION FOR STATE OR

STATE OF:

STATE OF:

.....................................................................

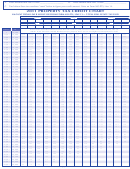

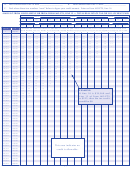

NAME OF POLITICAL SUBDIVISION. See table on back.

00

00

3. Wages and commissions ............................................................................................................. 3

3

00

00

4. Other (describe nature) _________________________________ ............................................. 4

4

00

00

5. Total — Add Lines 3 and 4. .......................................................................................................... 5

5

00

00

6. Less: related adjustments (from Federal Form 1040A, Line 20, OR Federal Form 1040, Line 36). .. 6

6

00

00

7. Net amounts — Subtract Line 6 from Line 5. ............................................................................... 7

7

%

%

8. Percentage of your income taxed — Divide Line 7 by Line 1. ..................................................... 8

8

00

00

9. Maximum credit — Multiply Line 2 by percentage on Line 8. ....................................................... 9

9

10. Income tax you paid to another state or political subdivision. This is not tax withheld.

00

00

The income tax is reduced by all credits, except withholding and estimated tax. ............................ 10

10

11. Credit — Enter the smaller amount of Line 9 or Line 10 here and on Form MO‑1040,

Line 26Y or Line 26S. (If you have multiple credits, add the amounts on Line 11 from

00

00

each Form MO‑CR before entering on Form MO‑1040 ............................................................... 11

11

For Privacy Notice see instructions

MO 860-1095 (12-2011)

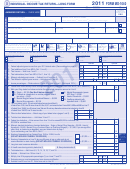

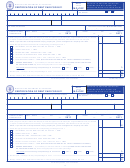

2011

Attachment Sequence No. 1040-03

MISSOURI DEPARTMENT OF REVENUE

CREDIT FOR INCOME TAXES PAID TO

FORM

MO-CR

OTHER STATES

OR POLITICAL SUBDIVISIONS

• A ttach a copy of all income tax returns for each

Complete this form if you or your spouse have income from another state or

state or political subdivision.

political subdivision. If you had multiple credits, complete a separate form for

each state or political subdivision.

• Attach Form MO-CR to Form MO-1040.

YOUR NAME

YOUR SOCIAL SECURITY NO.

YOUR SPOUSE’S NAME

SPOUSE’S SOCIAL SECURITY NO.

YOURSELF

SPOUSE

1. Claimant’s total adjusted gross income

00

00

(Form MO‑1040, Line 5Y and Line 5S) ......................................................................................... 1

1

2. Claimant’s Missouri income tax

00

00

(Form MO‑1040, Line 25Y and Line 25S) .................................................................................... 2

2

USE TWO LETTER ABBREVIATION FOR STATE OR

STATE OF:

STATE OF:

NAME OF POLITICAL SUBDIVISION. See table on back.

.....................................................................

00

00

3. Wages and commissions ............................................................................................................. 3

3

00

00

4. Other (describe nature) _________________________________ ............................................. 4

4

00

00

5. Total — Add Lines 3 and 4. .......................................................................................................... 5

5

00

00

6. Less: related adjustments (from Federal Form 1040A, Line 20, OR Federal Form 1040, Line 36). .. 6

6

00

00

7. Net amounts — Subtract Line 6 from Line 5. ............................................................................... 7

7

%

%

8. Percentage of your income taxed — Divide Line 7 by Line 1. ..................................................... 8

8

00

00

9. Maximum credit — Multiply Line 2 by percentage on Line 8. ....................................................... 9

9

10. Income tax you paid to another state or political subdivision. This is not tax withheld.

00

00

The income tax is reduced by all credits, except withholding and estimated tax. ............................ 10

10

11. Credit — Enter the smaller amount of Line 9 or Line 10 here and on Form MO‑1040,

Line 26Y or Line 26S. (If you have multiple credits, add the amounts on Line 11 from

00

00

each Form MO‑CR before entering on Form MO‑1040 ............................................................... 11

11

For Privacy Notice see instructions

MO 860-1095 (12-2011)

21

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44