Form Mo-1040 - Booklet Missouri Individual Income Tax Long Form - 2011 Page 2

ADVERTISEMENT

ELECTRONIC FILING OPTIONS

FEDERAL/STATE E-FILE: Missouri, in cooperation with the Internal Revenue Service

(IRS), offers a joint federal/state filing of individual income tax returns. There are two

ways that you may e-file your federal and state income tax returns:

1) Y ou can electronically file your federal and state returns online from web sites

provided by approved software providers. Many providers offer free filing

if you meet certain conditions. A list of approved providers can be found at

2) Y ou can have a tax preparer (if approved by the IRS) electronically file your federal

and state returns for you, usually for a fee. A list of approved tax preparers can be

found at

BENEFITS OF ELECTRONIC FILING

• C onvenience: You can electronically file 24 hours a day, 7 days a week.

• Security: Your tax return information is encrypted and transmitted over secure lines to

ensure confidentiality.

• A ccuracy: Electronic filed returns have up to 13 percent fewer errors than paper returns.

• D irect Deposit: You can have your refund direct deposited into your bank account.

• P roof of Filing: An acknowledgment is issued when your return is received and accepted.

Visit our web site at

In addition to electronic filing information found on our web site, you can:

• E -mail us

• G et answers to frequently asked

questions

• G et the status of your refund or

balance due

• U se our Fill-in Forms that Calculate

• P ay your taxes online

• D ownload Missouri and Federal tax forms

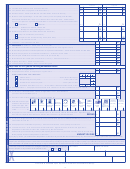

2-D Barcode Returns -

If you plan on filing a paper

return, you should consider 2-D barcode filing. The software

encodes all your tax information into a 2-D barcode, which

allows your return to be processed in a fraction of the time it takes to process a traditional paper

return. If you use software to prepare your return, check our web site for approved 2-D barcode

software companies. Also, check out the Department’s fill-in forms that calculate and have a 2-D

barcode. You can have your refund direct deposited into your bank account when you use the

Department’s fill-in forms. If your form has a 2-D barcode, the REFUND returns should be mailed to:

Department of Revenue, P.O. Box 3222, Jefferson City, MO 65105-3222 and returns with a balance

due should be mailed to: Department of Revenue, P.O. Box 3370, Jefferson City, MO 65105-3370.

2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44