Page 4 of 7

Section 3

Personal Asset Information

(Continued)

Total value of vehicles listed from attachment [current market value X .8 less any loan balance(s)]

(6d) $

Add lines (6a) through (6d) = (6)

$

Other valuable items

.

(artwork, collections, jewelry, items of value in safe deposit boxes, etc)

Description of asset:

Current Market Value

Less Loan Balance

= (7a) $

$

X .8 = $

– $

Description of asset:

Current Market Value

Less Loan Balance

$

X .8 = $

– $

= (7b) $

Total value of valuable items listed from attachment [current market value X .8 less any loan balance(s)]

(7c) $

Add lines (7a) through (7c) = (7)

$

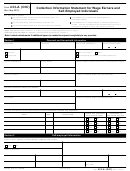

Section 4

Business Asset Information (for Self-Employed)

List business assets such as bank accounts, tools, books, machinery, equipment, business vehicles and real property that is

owned/leased/rented. If additional space is needed, attach a list of items. Do not enter a number less than zero.

Cash

Checking

Savings

Money Market

Online Account

Stored Value Card

Bank Name

Account Number

(8a) $

Checking

Savings

Money Market

Online Account

Stored Value Card

Bank Name

Account Number

(8b) $

Total value of bank accounts from attachment

(8c) $

Add lines (8a) through (8c) for total bank account(s) = (8)

$

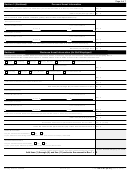

Description of asset:

Current Market Value

Less Loan Balance

$

X .8 = $

– $

= (9a) $

Description of asset:

Current Market Value

Less Loan Balance

$

X .8 = $

– $

= (9b) $

Total value of assets listed from attachment [current market value X .8 less any loan balance(s)]

(9c) $

Add lines (9a) through (9c) = (9)

$

IRS allowed deduction for professional books and tools of trade – (10) $ [4,290]

Enter the value of line (9) minus line (10). If less than zero enter zero. = (11) $

Notes Receivable

Do you have notes receivable?

Yes

No

If yes, attach current listing which includes name and amount of note(s) receivable.

Accounts Receivable

Do you have accounts receivable?

Yes

No

If yes, you may be asked to provide a list of the Account(s) Receivable.

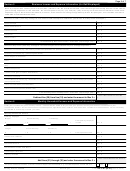

Box 1 Available Equity in Assets

Do not include amount on the lines with a letter beside the number.

Add lines (1) through (8), and line (11) and enter the amount in Box 1 =

$

433-A (OIC)

Catalog Number 55896Q

Form

(Rev. 5-2012)

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28