Page 5 of 6

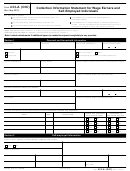

Section 5

Calculate Your Minimum Offer Amount

The next steps calculate your minimum offer amount. The amount of time you take to pay your offer in full will affect your minimum offer amount.

Paying over a shorter period of time will result in a smaller minimum offer amount.

If you will pay your offer in 5 months or less, multiply "Remaining Monthly Income" (Box 4) by 12 to get "Future Remaining Income."

Enter the amount from Box 4 here

Box 5 Future Remaining Income

X 12 =

$

$

If you will pay your offer in more than 5 months, multiply "Remaining Monthly Income" (from Box 4) by 24 to get "Future Remaining Income."

Enter the amount from Box 4 here

Box 6 Future Remaining Income

X 24 =

$

$

Determine your minimum offer amount by adding the total available assets from Box 1 to amount in either Box 5 or Box 6.

Offer Amount

Enter the amount from Box 1 here*

Enter the amount from either Box 5 or Box 6

+

=

Do not enter a number less than zero

Must be more than zero

$

$

$

If you have special circumstances that would hinder you from paying this amount, explain them on Form 656, Offer in Compromise, Page 2,

"Explanation of Circumstances."

*You may exclude any equity in income producing assets shown in Section 2 of this form.

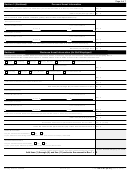

Section 6

Other Information

Additional information IRS needs to

Is the business currently in bankruptcy?

consider settlement of your tax debt. If this

Yes

No

business is currently in a bankruptcy

Has the business ever filed bankruptcy?

proceeding, the business is not eligible to

apply for an offer.

Yes

No

If yes, provide:

Date Filed

Date Dismissed or Discharged

(mm/dd/yyyy)

(mm/dd/yyyy)

Petition No.

Location Filed

Does this business have other business affiliations (e.g., subsidiary or parent companies)?

Yes

No

If yes, list the Name and Employer Identification Number:

Do any related parties (e.g., partners, officers, employees) owe money to the business?

Yes

No

Is the business currently, or in the past, a party to a lawsuit?

Yes

No If applicable, date the lawsuit was resolved:

In the past 10 years, has the business transferred any assets for less than their full value?

No If applicable, provide date and type of asset transferred:

Yes

Has the business been located outside the U.S. for 6 months or longer in the past 10 years?

Yes

No

Does the business have any funds being held in trust by a third party?

Yes

No If yes, how much $

Where:

Does the business have any lines of credit?

No If yes, credit limit $

Yes

Amount owed $

What property secures the line of credit?

433-B (OIC)

Catalog Number 55897B

Form

(Rev. 5-2012)

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28