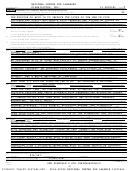

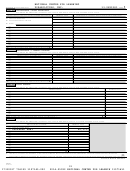

Form 990 - Return Of Organization Exempt From Income Tax - 2014 Page 11

ADVERTISEMENT

NATIONAL CENTER FOR LEARNING

DISABILITIES, INC.

13-2899381

10

Form 990 (2014)

Page

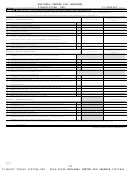

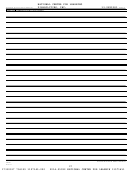

Part IX Statement of Functional Expenses

Section 501(c)(3) and 501(c)(4) organizations must complete all columns. All other organizations must complete column (A).

Check if Schedule O contains a response or note to any line in this Part IX ••••••••••••••••••••••••••

(A)

(B)

(C)

(D)

Do not include amounts reported on lines 6b,

Total expenses

Program service

Management and

Fundraising

7b, 8b, 9b, and 10b of Part VIII.

expenses

general expenses

expenses

Grants and other assistance to domestic organizations

1

and domestic governments. See Part IV, line 21

~

2

Grants and other assistance to domestic

33,500.

33,500.

individuals. See Part IV, line 22 ~~~~~~~

3

Grants and other assistance to foreign

organizations, foreign governments, and foreign

individuals. See Part IV, lines 15 and 16 ~~~

4

Benefits paid to or for members ~~~~~~~

5

Compensation of current officers, directors,

665,313.

567,643.

27,591.

70,079.

trustees, and key employees ~~~~~~~~

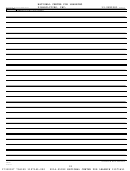

Compensation not included above, to disqualified

6

persons (as defined under section 4958(f)(1)) and

persons described in section 4958(c)(3)(B)

~~~

2,642,581.

2,246,340.

111,935.

284,306.

7

Other salaries and wages ~~~~~~~~~~

Pension plan accruals and contributions (include

8

83,059.

70,866.

3,444.

8,749.

section 401(k) and 403(b) employer contributions)

310,134.

264,606.

12,861.

32,667.

9

Other employee benefits ~~~~~~~~~~

264,751.

225,941.

10,915.

27,895.

10

Payroll taxes ~~~~~~~~~~~~~~~~

11

Fees for services (non-employees):

a

Management

~~~~~~~~~~~~~~~~

b

Legal

~~~~~~~~~~~~~~~~~~~~

58,000.

29.

28,750.

29,221.

c

Accounting

~~~~~~~~~~~~~~~~~

57,713.

57,713.

d

Lobbying

~~~~~~~~~~~~~~~~~~

Professional fundraising services. See Part IV, line 17

e

f

Investment management fees

~~~~~~~~

(If line 11g amount exceeds 10% of line 25,

g

Other.

503,881.

250.

249,769.

253,862.

column (A) amount, list line 11g expenses on Sch O.)

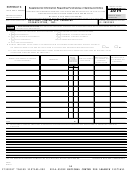

2,508.

1,244.

1,264.

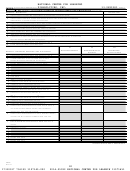

12

Advertising and promotion

~~~~~~~~~

235,415.

166,814.

8,356.

60,245.

Office expenses

~~~~~~~~~~~~~~~

13

1,513,427.

1,502,772.

2,905.

7,750.

14

Information technology

~~~~~~~~~~~

Royalties

~~~~~~~~~~~~~~~~~~

15

221,617.

162,086.

14,974.

44,557.

16

Occupancy ~~~~~~~~~~~~~~~~~

173,585.

140,754.

24,395.

8,436.

17

Travel

~~~~~~~~~~~~~~~~~~~

18

Payments of travel or entertainment expenses

for any federal, state, or local public officials

78,283.

73,079.

4,875.

329.

Conferences, conventions, and meetings ~~

19

20

Interest

~~~~~~~~~~~~~~~~~~

21

Payments to affiliates

~~~~~~~~~~~~

241,097.

232,858.

2,127.

6,112.

Depreciation, depletion, and amortization

~~

22

17,828.

15,281.

658.

1,889.

23

Insurance

~~~~~~~~~~~~~~~~~

Other expenses. Itemize expenses not covered

24

above. (List miscellaneous expenses in line 24e. If line

24e amount exceeds 10% of line 25, column (A)

amount, list line 24e expenses on Schedule O.)

~~

PROGRAM & EVALUATION

1,002,100.

1,001,895.

205.

a

DUES & SUBSCRIPTIONS

130,122.

92,156.

8,619.

29,347.

b

RECRUITMENT FEES

127,368.

808.

126,560.

c

EQUIPMENT LEASING & MAI

27,567.

27,401.

43.

123.

d

26,534.

12,746.

13,480.

308.

e

All other expenses

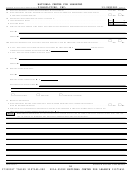

8,416,383.

6,895,538.

653,501.

867,344.

Total functional expenses.

Add lines 1 through 24e

25

Joint costs.

Complete this line only if the organization

26

reported in column (B) joint costs from a combined

educational campaign and fundraising solicitation.

|

Check here

if following SOP 98-2 (ASC 958-720)

990

Form

(2014)

432010 11-07-14

11

17330517 756359 1107145.000

2014.05092 NATIONAL CENTER FOR LEARNIN 11071451

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50