Form 990 - Return Of Organization Exempt From Income Tax - 2014 Page 16

ADVERTISEMENT

Schedule A (Form 990 or 990-EZ) 2014

Page

3

Part III Support Schedule for Organizations Described in Section 509(a)(2)

(Complete only if you checked the box on line 9 of Part I or if the organization failed to qualify under Part II. If the organization fails to

qualify under the tests listed below, please complete Part II.)

Section A. Public Support

Calendar year (or fiscal year beginning in) |

(a)

2010

(b)

2011

(c)

2012

(d)

2013

(e)

2014

(f)

Total

1

Gifts, grants, contributions, and

membership fees received. (Do not

include any "unusual grants.") ~~

2

Gross receipts from admissions,

merchandise sold or services per-

formed, or facilities furnished in

any activity that is related to the

organization's tax-exempt purpose

3

Gross receipts from activities that

are not an unrelated trade or bus-

iness under section 513 ~~~~~

4

Tax revenues levied for the organ-

ization's benefit and either paid to

or expended on its behalf ~~~~

5

The value of services or facilities

furnished by a governmental unit to

the organization without charge ~

~~~

6

Total.

Add lines 1 through 5

7

a

Amounts included on lines 1, 2, and

3 received from disqualified persons

b

Amounts included on lines 2 and 3 received

from other than disqualified persons that

exceed the greater of $5,000 or 1% of the

~~~~~~

amount on line 13 for the year

c

Add lines 7a and 7b ~~~~~~~

8 Public support

(Subtract line 7c from line 6.)

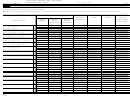

Section B. Total Support

Calendar year (or fiscal year beginning in) |

(a)

2010

(b)

2011

(c)

2012

(d)

2013

(e)

2014

(f)

Total

9

Amounts from line 6 ~~~~~~~

10a

Gross income from interest,

dividends, payments received on

securities loans, rents, royalties

and income from similar sources ~

Unrelated business taxable income

b

(less section 511 taxes) from businesses

acquired after June 30, 1975

~~~~

c

Add lines 10a and 10b ~~~~~~

11

Net income from unrelated business

activities not included in line 10b,

whether or not the business is

regularly carried on ~~~~~~~

12

Other income. Do not include gain

or loss from the sale of capital

assets (Explain in Part VI.) ~~~~

13

Total support.

(Add lines 9, 10c, 11, and 12.)

14 First five years.

If the Form 990 is for the organization's first, second, third, fourth, or fifth tax year as a section 501(c)(3) organization,

•••••••••••••••••••••••••••••••••••••••••••••••••••• |

check this box and

stop here

Section C. Computation of Public Support Percentage

15

Public support percentage for 2014 (line 8, column (f) divided by line 13, column (f))

~~~~~~~~~~~~

15

%

16

Public support percentage from 2013 Schedule A, Part III, line 15

••••••••••••••••••••

16

%

Section D. Computation of Investment Income Percentage

17

Investment income percentage for

2014

(line 10c, column (f) divided by line 13, column (f))

~~~~~~~~

17

%

18

Investment income percentage from

2013

Schedule A, Part III, line 17

~~~~~~~~~~~~~~~~~~

18

%

If the organization did not check the box on line 14, and line 15 is more than 33 1/3%, and line 17 is not

19

a

33 1/3% support tests - 2014.

more than 33 1/3%, check this box and

stop here.

The organization qualifies as a publicly supported organization ~~~~~~~~~~ |

b

33 1/3% support tests - 2013.

If the organization did not check a box on line 14 or line 19a, and line 16 is more than 33 1/3%, and

line 18 is not more than 33 1/3%, check this box and

stop here.

The organization qualifies as a publicly supported organization~~~~ |

20

Private foundation.

If the organization did not check a box on line 14, 19a, or 19b, check this box and see instructions •••••••• |

Schedule A (Form 990 or 990-EZ) 2014

432023 09-17-14

16

17330517 756359 1107145.000

2014.05092 NATIONAL CENTER FOR LEARNIN 11071451

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50