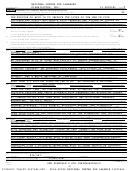

Form 990 - Return Of Organization Exempt From Income Tax - 2014 Page 12

ADVERTISEMENT

NATIONAL CENTER FOR LEARNING

DISABILITIES, INC.

13-2899381

11

Form 990 (2014)

Page

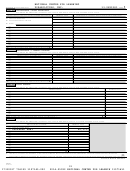

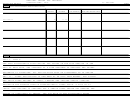

Balance Sheet

Part X

Check if Schedule O contains a response or note to any line in this Part X •••••••••••••••••••••••••••••

(A)

(B)

Beginning of year

End of year

437,186.

357,419.

1

Cash - non-interest-bearing

~~~~~~~~~~~~~~~~~~~~~~~~~

1

1,203,648.

113,869.

2

Savings and temporary cash investments

~~~~~~~~~~~~~~~~~~

2

1,365,614.

526,629.

3

Pledges and grants receivable, net

~~~~~~~~~~~~~~~~~~~~~

3

4

Accounts receivable, net ~~~~~~~~~~~~~~~~~~~~~~~~~~

4

5

Loans and other receivables from current and former officers, directors,

trustees, key employees, and highest compensated employees. Complete

Part II of Schedule L ~~~~~~~~~~~~~~~~~~~~~~~~~~~~

5

6

Loans and other receivables from other disqualified persons (as defined under

section 4958(f)(1)), persons described in section 4958(c)(3)(B), and contributing

employers and sponsoring organizations of section 501(c)(9) voluntary

employees' beneficiary organizations (see instr). Complete Part II of Sch L ~~

6

7

Notes and loans receivable, net

~~~~~~~~~~~~~~~~~~~~~~~

7

8

Inventories for sale or use

~~~~~~~~~~~~~~~~~~~~~~~~~~

8

141,817.

162,374.

9

Prepaid expenses and deferred charges

~~~~~~~~~~~~~~~~~~

9

10

a

Land, buildings, and equipment: cost or other

1,695,871.

basis. Complete Part VI of Schedule D

~~~

10a

1,009,997.

284,196.

685,874.

b

Less: accumulated depreciation

~~~~~~

10b

10c

70,920.

0.

11

Investments - publicly traded securities

~~~~~~~~~~~~~~~~~~~

11

12

Investments - other securities. See Part IV, line 11

~~~~~~~~~~~~~~

12

13

Investments - program-related. See Part IV, line 11

~~~~~~~~~~~~~

13

14

Intangible assets

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

14

16,810.

79,144.

15

Other assets. See Part IV, line 11 ~~~~~~~~~~~~~~~~~~~~~~

15

3,520,191.

1,925,309.

16

Total assets.

Add lines 1 through 15 (must equal line 34) ••••••••••

16

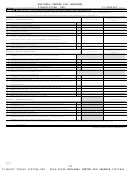

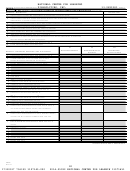

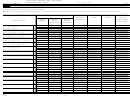

915,491.

593,024.

17

Accounts payable and accrued expenses

~~~~~~~~~~~~~~~~~~

17

18

Grants payable

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

18

281,966.

946.

19

Deferred revenue

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

19

20

Tax-exempt bond liabilities

~~~~~~~~~~~~~~~~~~~~~~~~~

20

21

Escrow or custodial account liability. Complete Part IV of Schedule D

~~~~

21

22

Loans and other payables to current and former officers, directors, trustees,

key employees, highest compensated employees, and disqualified persons.

Complete Part II of Schedule L ~~~~~~~~~~~~~~~~~~~~~~~

22

23

Secured mortgages and notes payable to unrelated third parties ~~~~~~

23

24

Unsecured notes and loans payable to unrelated third parties ~~~~~~~~

24

25

Other liabilities (including federal income tax, payables to related third

parties, and other liabilities not included on lines 17-24). Complete Part X of

86,772.

62,375.

Schedule D

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

25

1,284,229.

656,345.

26

Total liabilities.

Add lines 17 through 25 ••••••••••••••••••

26

X

Organizations that follow SFAS 117 (ASC 958), check here

|

and

complete lines 27 through 29, and lines 33 and 34.

890,788.

493,592.

27

Unrestricted net assets

~~~~~~~~~~~~~~~~~~~~~~~~~~~

27

1,345,174.

775,372.

28

Temporarily restricted net assets

~~~~~~~~~~~~~~~~~~~~~~

28

29

Permanently restricted net assets

~~~~~~~~~~~~~~~~~~~~~

29

Organizations that do not follow SFAS 117 (ASC 958), check here

|

and complete lines 30 through 34.

30

Capital stock or trust principal, or current funds

~~~~~~~~~~~~~~~

30

31

Paid-in or capital surplus, or land, building, or equipment fund

~~~~~~~~

31

32

Retained earnings, endowment, accumulated income, or other funds

~~~~

32

2,235,962.

1,268,964.

33

33

Total net assets or fund balances ~~~~~~~~~~~~~~~~~~~~~~

3,520,191.

1,925,309.

34

Total liabilities and net assets/fund balances ••••••••••••••••

34

990

Form

(2014)

432011

11-07-14

12

17330517 756359 1107145.000

2014.05092 NATIONAL CENTER FOR LEARNIN 11071451

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50