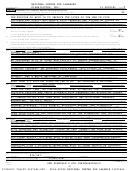

Form 990 - Return Of Organization Exempt From Income Tax - 2014 Page 27

ADVERTISEMENT

NATIONAL CENTER FOR LEARNING

DISABILITIES, INC.

13-2899381

Schedule C (Form 990 or 990-EZ) 2014

Page

2

Part II-A

Complete if the organization is exempt under section 501(c)(3) and filed Form 5768 (election under

section 501(h)).

J

A

Check

if the filing organization belongs to an affiliated group (and list in Part IV each affiliated group member's name, address, EIN,

expenses, and share of excess lobbying expenditures).

J

B

Check

if the filing organization checked box A and "limited control" provisions apply.

(a)

Filing

(b)

Affiliated group

Limits on Lobbying Expenditures

organization's

totals

(The term "expenditures" means amounts paid or incurred.)

totals

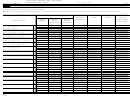

1 a

Total lobbying expenditures to influence public opinion (grass roots lobbying)

~~~~~~~~~~

57,713.

b

Total lobbying expenditures to influence a legislative body (direct lobbying)

~~~~~~~~~~~

57,713.

c

Total lobbying expenditures (add lines 1a and 1b)

~~~~~~~~~~~~~~~~~~~~~~~~

7,491,326.

d

Other exempt purpose expenditures

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

7,549,039.

e

Total exempt purpose expenditures (add lines 1c and 1d)

~~~~~~~~~~~~~~~~~~~~

527,452.

f

Lobbying nontaxable amount. Enter the amount from the following table in both columns.

If the amount on line 1e, column (a) or (b) is:

The lobbying nontaxable amount is:

Not over $500,000

20% of the amount on line 1e.

Over $500,000 but not over $1,000,000

$100,000 plus 15% of the excess over $500,000.

Over $1,000,000 but not over $1,500,000

$175,000 plus 10% of the excess over $1,000,000.

Over $1,500,000 but not over $17,000,000

$225,000 plus 5% of the excess over $1,500,000.

Over $17,000,000

$1,000,000.

131,863.

g

Grassroots nontaxable amount (enter 25% of line 1f)

~~~~~~~~~~~~~~~~~~~~~~

0.

h

Subtract line 1g from line 1a. If zero or less, enter -0-

~~~~~~~~~~~~~~~~~~~~~~

0.

i

Subtract line 1f from line 1c. If zero or less, enter -0-

~~~~~~~~~~~~~~~~~~~~~~~

j

If there is an amount other than zero on either line 1h or line 1i, did the organization file Form 4720

reporting section 4911 tax for this year? ••••••••••••••••••••••••••••••••••••••

Yes

No

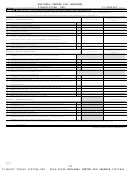

4-Year Averaging Period Under section 501(h)

(Some organizations that made a section 501(h) election do not have to complete all of the five columns below.

See the separate instructions for lines 2a through 2f.)

Lobbying Expenditures During 4-Year Averaging Period

Calendar year

(a)

2011

(b)

2012

(c)

2013

(d)

2014

(e)

Total

(or fiscal year beginning in)

371,595.

411,903.

704,353.

527,452. 2,015,303.

2 a

Lobbying nontaxable amount

b

Lobbying ceiling amount

3,022,955.

(150% of line 2a, column(e))

136,292.

155,467.

168,037.

57,713.

517,509.

c

Total lobbying expenditures

92,899.

102,976.

176,088.

131,863.

503,826.

d

Grassroots nontaxable amount

e

Grassroots ceiling amount

755,739.

(150% of line 2d, column (e))

f

Grassroots lobbying expenditures

Schedule C (Form 990 or 990-EZ) 2014

432042

10-21-14

27

17330517 756359 1107145.000

2014.05092 NATIONAL CENTER FOR LEARNIN 11071451

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50