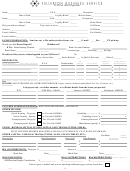

Tax Year 2014 Income Tax Organizer Template Page 2

ADVERTISEMENT

Interest Paid (Provide 1098 Forms or lender information and ID numbers; if you purchased or refinanced,

please provide settlement statement (HUD) to maximize deductions)

Interest Paid – Primary Residence: $_______

Equity Loan(s)/Line of Credit: $_______

Loan Points: $_______

Mortgage Insurance: $_______

Investment Interest: $_______

Charitable Contributions (If over $250 in non-cash contributions, provide details of contributions. New rules

require that taxpayer retain documentation for all cash contributions)

Cash/Check: $_______

Non-cash (clothing, materials, etc.): $_______

Charitable mileage: _______

Miscellaneous Itemized Deductions (May need to exceed 2% of income to be a benefit)

□ Job-related expenses $_______ (Union dues, uniform cost/maintenance, tools/supplies,

licenses/fees, trade journals, education/seminars, home office; work clothing is not deductible if adaptable

to every day wear)

□ Gambling losses $_______ (Deductible only up to the amount of gambling winnings reported)

□ Legal/attorney fees $_______ (Deductible only if related to producing or collecting taxable income)

□ Theft/Casualty Losses $_______ (Bring insurance paperwork regarding loss)

□ Miscellaneous: $_______ Tax preparation fees, financial planning/investment expenses, safe deposit

box, job-hunting/resume-writing expenses, hobby expenses (ask your preparer for details)

Step 5: Questions for all Taxpayers

□ Yes □ No

Did you pay child or dependent care so you could work or go to school?

(If yes, please provide: name of provider, address, tax ID# or SS# and amount paid)

□ Yes □ No

Did you pay or receive (circle one) alimony in the past year? Do not include child support.

(To/From: Name____________________ SS#___________________ Amount $_______)

□ Yes □ No

Did you pay college tuition for you or a dependent?

(If yes, please provide Form 1098-T or amount of tuition paid)

□ Yes □ No

Did you pay any interest on student loans?

(If yes, please provide Form 1098-E or amount of interest paid)

□ Yes □ No

Were you granted or did you exercise any employer stock options?

(If yes, please provide details on these transactions.)

□ Yes □ No

Did you move because of work/job change?

(If yes, please provide details on distances for a possible moving expense deduction.)

□ Yes □ No

Did you (or do you plan to before April 15) contribute to a traditional or Roth IRA?

(If yes, Self $_______

Spouse $_______)

□ Yes □ No

Were you and your dependents covered by a health insurance plan for all of 2014?

(Additional documents may be required for filing (1095-A))

Step 6: Self-Employment/Business and/or Rental Property

□ Yes □ No

Do you operate your own business? If so, please provide details on income/expenses.

□ Yes □ No

□

Do you own a rental property?

(# of properties____)

Sold a rental last year.

Provide details on expenses by category separated by property (see below)

Expense categories for businesses and/or rental(s):

Advertising

Association Dues

Automobile Expenses

Bank Charges

Commissions/Fees Paid

Contract Labor

Insurance

Interest Paid

Legal/Professional Fees

Management Fees

Office Expenses

Postage/Freight

Rent Paid

Repairs/Maintenance

Supplies

Taxes (real estate, mercantile, etc.)

Utilities

Wages Paid

2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3