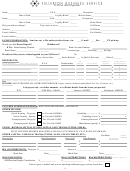

Tax Year 2014 Income Tax Organizer Template Page 3

ADVERTISEMENT

Tax Preparation Checklist

Please provide the following documentation:

□

1. Your completed Income Tax Organizer

□

2. All forms W-2 (wages), 1099 (1099-INT for interest, 1099-DIV for dividends, 1099-B for sale

of securities, 1099-R for annuities, pensions, IRA or other retirement plan withdrawals, 1099-G

for state refund and/or unemployment compensation, 1099-SSA for Social Security, 1099-MISC

for other income, 1099-C for Cancellation of Debt) and Schedules K-1 for partnerships and S-

Corporations.

□

3. If you are a new client, provide copies of the prior 2 years tax returns.

□

4. If you bought or refinanced a home or property, bring in a copy of your closing statement.

□

5. Details of estimated tax payments made (federal, state, local), if any.

□

6. List of itemized deductions by category for medical, taxes, mortgage interest, charitable and

miscellaneous deductions.

□

7. Proof of medical insurance (1095-A) if purchased through the marketplace.

□

8. List of income and expenses for business and/or rental activities.

Tax questions, concerns, feedback…… (Write down anything you would like to discuss further)

__________________________________________________________________________________

__________________________________________________________________________________

Our Policies

Salabsky Financial Services would like to thank you very much for your business!

Preparation: We will prepare your tax return based on the information you provide us. We recommend

you keep the information needed to verify the items reported for an extended period of time. Unless

otherwise stated, the services for preparation of your return do not include auditing or review. We

will provide you with one copy of your return when it is completed. **Additional copies can be

obtained for a fee and can be distributed via mail, fax or email.

Payment is due upon completion of your returns (cash, check or major credit card).

Privacy: The nature of our work requires us to collect certain non-public information. All information we

obtain about you will be provided by you or obtained with your permission. Our firm has procedures and

policies in place to protect your confidential information. We will not disclose your personal information

to a third party, except where required by law.

Contact Us!

There are many events during the year that can affect your tax situation. In most situations, treatment is

established at the time the transaction occurs. However, negative tax effects can be avoided by

proper planning. Please contact us in advance about the possible tax effects of a transaction or event,

including any of the following:

IRA/401k/pension distributions

Job change/retirement

Notice from IRS or other tax bureau

Sale or purchase of residence/real estate

Marriage or birth of a child

Significant change in income or deductions

Divorce or separation

Sale/purchase/start of a business

Life insurance surrender/exchange

Debt cancellation/forgiveness

Salabsky Financial Services

Phone: (610) 866-2342

Fax: (610) 866-2526

Email:

Web:

3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3