Publication 505 - Tax Withholding And Estimated Tax Page 22

ADVERTISEMENT

Required Annual Payment

tract your expected withholding from your re-

Fiscal year taxpayers. If your tax year does

quired annual payment. You usually must pay

not start on January 1, your payment due dates

this difference in four equal installments. (See

are:

You figure the total amount you must pay for

When To Pay Estimated Tax and How To Figure

2002 through withholding and estimated tax

1) The 15th day of the 4th month of your

Each Payment, later.)

payments on lines 14a through 14c of the 2002

fiscal year,

Estimated Tax Worksheet.

If your total expected tax on line 13c, minus

your expected withholding on line 15, is less

2) The 15th day of the 6th month of your

General rule. The total amount you must pay

than $1,000, you do not need to make estimated

fiscal year,

is the smaller of:

tax payments.

3) The 15th day of the 9th month of your

1) 90% of your total expected tax for 2002, or

fiscal year, and

Withholding. Your expected withholding for

2) 100% of the total tax shown on your 2001

2002 includes the income tax you expect to be

4) The 15th day of the 1st month after the

return. Your 2001 tax return must cover all

withheld from all sources (wages, pensions and

end of your fiscal year.

12 months.

annuities, etc.). It also includes excess social

You do not have to make the last payment

security and railroad retirement tax you expect

listed above if you file your income tax return by

Exceptions. There are exceptions to the gen-

to be withheld from your wages.

the last day of the first month after the end of

eral rule for certain higher income taxpayers and

For this purpose, you will have excess social

your fiscal year and pay all the tax you owe with

for farmers and fishermen.

security or tier 1 railroad retirement tax withhold-

your return.

ing for 2002 only if your wages from two or more

Higher income taxpayers. If your adjusted

employers are more than $84,900.

gross income (AGI) for 2001 was more than

When To Start

$150,000 ($75,000 if your filing status for 2002 is

married filing a separate return), substitute

You do not have to make estimated tax pay-

112% for 100% in (2) above. This rule does not

ments until you have income on which you will

When To Pay

apply to farmers and fishermen.

owe the tax. If you have income subject to esti-

For 2001, AGI is the amount shown on Form

Estimated Tax

mated tax during the first payment period, you

1040 – line 34; Form 1040A – line 20; and Form

must make your first payment by the due date

1040EZ – line 4.

for the first payment period. You can pay all your

For estimated tax purposes, the year is divided

estimated tax at that time, or you can pay it in

Farmers and fishermen. If at least

into four payment periods. Each period has a

installments. If you choose to pay in install-

two-thirds of your gross income for 2001 or 2002

specific payment due date. If you do not pay

ments, make your first payment by the due date

is from farming or fishing, your required annual

enough tax by the due date of each of the pay-

for the first payment period. Make your remain-

payment is the smaller of:

ment periods, you may be charged a penalty

ing installment payments by the due dates for

even if you are due a refund when you file your

1) 66

2

/

% (.6667) of your total tax for 2002, or

the later periods.

3

income tax return. The following chart gives the

2) 100% of the total tax shown on your 2001

payment periods and due dates for estimated

No income subject to estimated tax during

return. (Your 2001 tax return must cover

tax payments.

first period. If you first have income subject to

all 12 months.)

estimated tax during a later payment period, you

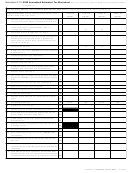

Table 2.3

For definitions of “gross income from farm-

must make your first payment by the due date

ing” and “gross income from fishing,” see Farm-

for that period. You can pay your entire esti-

For the period:

Due date:

ers and Fishermen later under When To Pay

mated tax by the due date for that period or you

Jan. 1* through March 31 . . . .

April 15

Estimated Tax.

can pay it in installments by the due date for that

April 1 through May 31 . . . . .

June 15

period and the due dates for the remaining peri-

June 1 through August 31 . . .

September 15

Total tax for 2001. Your 2001 total tax on

Sept. 1 through Dec. 31 . . . . .

Jan. 15 next

ods. The following chart shows the dates for

Form 1040 is the amount on line 58 reduced by

year**

making installment payments.

the total of the amounts on lines 54, 61a, and 63,

*If your tax year does not begin on January 1, see

any credit from Form 4136 included on line 65,

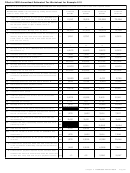

Table 2.4

Fiscal year taxpayers, later.

any recapture of a federal mortgage subsidy and

**See January payment, later.

If you first have

any uncollected social security, Medicare, or

income on which

railroad retirement tax included on line 58, and

you must pay

Make a

Make later in-

Saturday, Sunday, holiday rule. If the due

any tax on excess contributions to IRAs and

estimated tax:

payment by:

stallments by:

date for making an estimated tax payment falls

medical savings accounts, and on excess accu-

Before April 1

April 15

June 15

on a Saturday, Sunday, or legal holiday, the

mulations in qualified retirement plans from

September 15

payment will be on time if you make it on the next

Form 5329 included on line 55.

January 15

day that is not a Saturday, Sunday, or legal

On Form 1040A, it is line 36 reduced by the

next year*

holiday. For example, a payment due Saturday,

amounts on lines 39a and 40. On Form 1040EZ,

After March 31

June 15, 2002, will be on time if you make it by

it is line 11 reduced by line 9a.

and before

Monday, June 17, 2002.

June 1

June 15

September 15

Example 2.5. Jeremy Martin’s total tax on

January 15

his 2001 return was $45,000, and his expected

next year*

January payment. If you file your 2002 Form

After May 31 and

tax for 2002 is $70,000. His 2001 AGI was

1040 or Form 1040A by January 31, 2003, and

before

$180,000. Because Jeremy had more than

pay the rest of the tax you owe, you do not need

Sept. 1

September 15

January 15

$150,000 of AGI in 2001, he figures his required

to make your estimated tax payment that would

next year*

annual payment as follows. He determines that

be due on January 15, 2003.

After August 31

January 15

90% of his expected tax for 2002 is $63,000 (.90

next year*

(None)

× $70,000). Next, he determines that 112% of

Example 2.6. Janet Adams does not pay

*See January payment and Saturday, Sunday,

the tax shown on his 2001 return is $50,400.

any estimated tax due for 2002. She files her

holiday rule under When To Pay Estimated Tax,

Finally, he determines that his required annual

earlier.

2002 income tax return and pays the balance

payment is $50,400, the smaller of the two.

due as shown on her return on January 24,

2003.

Change in estimated tax. After making your

Total Estimated

Janet’s estimated tax for the fourth payment

first estimated tax payment, changes in your

Tax Payments

period is considered to have been paid on time.

income, adjustments, deductions, credits, or ex-

However, she may owe a penalty for not making

emptions may make it necessary for you to

Figure the total amount you must pay for 2002

the first three estimated tax payments. Any pen-

refigure your estimated tax. Pay the unpaid bal-

through estimated tax payments on lines 15 and

alty for not making those payments will be fig-

ance of your amended estimated tax by the next

16 of the 2002 Estimated Tax Worksheet. Sub-

ured up to January 24, 2003.

payment due date after the change or in install-

Page 22

Chapter 2 Estimated Tax for 2002

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49