Publication 505 - Tax Withholding And Estimated Tax Page 26

ADVERTISEMENT

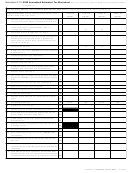

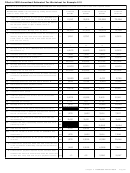

Worksheet 2.10. (continued) 2002 Annualized Estimated Tax Worksheet

Section B (For Figuring Your Annualized Estimated Self-Employment Tax)—Complete each column after end of period shown.

1/1/01 to

1/1/01 to

1/1/01 to

1/1/01 to

3/31/01

5/31/01

8/31/01

12/31/01

27

Net earnings from self-employment for the period

27

28

Prorated social security tax limit

28

$21,225

$35,375

$56,600

$84,900

29

Enter actual wages for the period subject to social

security tax or the 6.2% portion of the 7.65% railroad

retirement (tier 1) tax

29

30

Subtract line 29 from line 28. If zero or less, enter -0-

30

31

Annualization amounts

31

0.496

0.2976

0.186

0.124

32

Multiply line 31 by the smaller of line 27 or line 30

32

33

Annualization amounts

33

0.116

0.0696

0.0435

0.029

34

Multiply line 27 by line 33

34

35a Add lines 32 and 34. Enter the result here and on

line 13 of Section A

35a

8

4.8

3

2

b Annualization amounts

35b

c Deduction for one-half of self-employment tax. Divide

line 35a by 35b. Enter the result here. Also use this

result to figure your adjusted gross income on line 1

35c

Note. If line 7 is more than line 8, go to

If you filed a 2001 Form 1040, these include:

3) 75% (.75) for the third period, or

line 18.

4) 100% (1.00) for the fourth period.

13. Subtract line 9 from line 8. If zero or

1) Taxes on qualified plans, including IRAs,

less, enter 0 . . . . . . . . . . . . . . . . . .

and other tax favored accounts,

You may choose to include your actual with-

14. Multiply line 13 by 10% (.10) . . . . . . . .

holding through the due date for each period on

15. Enter the amount, if any, of your

2) Advance earned income credit,

qualified 5-year gain. Do not enter more

line 26c. You can make this choice separately

3) Household employment taxes that are re-

than the amount on line 13. . . . . . . . .

for the taxes withheld from your wages and all

16. Multiply line 15 by 2% (.02) . . . . . . . .

ported on your income tax return, and

other withholding. For an explanation of what to

17. Subtract line 16 from line 14 . . . . . . . .

include in withholding, see Total Estimated Tax

4) Write-in amounts on line 58 of Form 1040.

Note. If line 13 minus line 15 is more

Payments under How To Figure Estimated Tax,

than zero and equal to line 6, enter 0 on

Do not include tax on recapture of a federal

lines 20, 25, and 28, and go to line 29.

earlier.

mortgage subsidy, social security and Medicare

18. Enter the smaller of line 1 or line 6 . . .

tax on unreported tip income, and any uncol-

19. Subtract line 13 from line 18 . . . . . . . .

Section B. If you had income from self-em-

20. Multiply line 19 by 20% (.20) . . . . . . . .

lected social security, Medicare, or railroad re-

ployment during any period, complete the work-

Note. If line 4 is zero or blank, skip lines

tirement tax.

21 through 25 and read the note above

sheet column for that period to figure your

If you filed a 2001 Form 1040A, “other tax” is

line 26.

annualized self-employment tax before you

any advance earned income credit payments on

21. Enter the smaller of line 2 or line 4 . . .

complete the worksheet column for that period

line 35 of that form.

22. Add lines 2 and 11 . . . . . . . . . . . . . .

in Section A.

23. Subtract line 1 from line 22. If zero or

Line 16. Include all the credits (other than

less, enter 0 . . . . . . . . . . . . . . . . . .

withholding credits) you can claim because of

24. Subtract line 23 from line 21. If zero or

Nonresident aliens. If you will file Form

events that occurred during the period. If you are

less, enter 0 . . . . . . . . . . . . . . . . . .

1040NR and you do not receive wages as an

25. Multiply line 24 by 25% (.25) . . . . . . . .

using your 2001 return as a guide and filed Form

employee subject to U.S. income tax withhold-

Note. If line 3 is zero or blank, go to line

1040, your 2001 credits included the credits on

ing, the instructions for the worksheet are modi-

29 . . . . . . . . . . . . . . . . . . . . . . . .

lines 61a, 63, and 65, and the credits that are

fied as follows.

26. Add lines 11, 13, 19, and 24 . . . . . . . .

included in the total on line 51. If you filed Form

27. Subtract line 26 from line 1. If zero or

1040A, your 2001 credits included the credits on

less, enter 0 . . . . . . . . . . . . . . . . . .

1) Skip the first column.

28. Multiply line 27 by 28% (.28) . . . . . . . .

lines 39a, and 40.

2) On line 1, enter your income for the period

29. Add lines 12, 17, 20, 25, and 28 . . . . .

Line 26a. If line 24 is smaller than line 21 and

30. Tax on the amount on line 1 from the

that is effectively connected with a U.S.

you are not certain of the estimate of your 2002

2002 Tax Rate Schedule . . . . . . . . . .

trade or business.

31. Tax. Enter the smaller of line 29 or line

tax, you can avoid a penalty by entering the

30 here and on line 12 of the 2002

3) On line 17, increase your entry by the

amount from line 21 on line 26a.

Annualized Estimated Tax Worksheet . .

amount determined by multiplying your in-

Line 26c. Include all estimated tax payments

come for the period that is not effectively

A collectibles gain or loss is any gain or

credited to 2002 and federal income tax with-

connected with a U.S. trade or business by

loss from the sale or exchange of a work of art,

holding through the payment due date for the

the following:

rug, antique, metal, gem, stamp, coin, or alco-

period. Also include excess social security and

holic beverage or other collectible that is a capi-

excess railroad retirement for the period.

a) 72% for the second column,

tal asset and that was held more than one year.

Your withholding is considered paid in four

b) 45% for the third column, and

equal installments, one on the due date of each

Line 13. Enter your self-employment tax for

payment period. To figure the amount to include

c) 30% for the fourth column. However, if

each period from line 35a.

on line 26c for each period, multiply your total

you can use a treaty rate lower than

expected withholding for 2002 by:

30%, use the percentages determined

Line 14. Include all the taxes you will owe

by multiplying your treaty rate by 2.4,

(other than income tax and self-employment tax)

1) 25% (.25) for the first period,

because of events that occurred during the pe-

1.5, and 1, respectively, instead of the

riod.

2) 50% (.50) for the second period,

above percentages.

Page 26

Chapter 2 Estimated Tax for 2002

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49