Publication 505 - Tax Withholding And Estimated Tax Page 36

ADVERTISEMENT

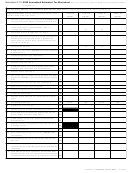

Table 3.1

3. Add lines 1 and 2. If $4,984.80 or less,

$36,200 working for Leather Design. Shoe Com-

stop here. You cannot claim the credit.

pany withheld $2,976 for social security tax.

Maximum

4. Social security and tier 1 RRTA tax

Leather Design withheld $2,244.40 for social

wages

Maximum

limit . . . . . . . . . . . . . . . . . . . . .

4,984.80

security tax. Because he worked for two employ-

subject

tax to be

5. Excess. Subtract line 4 from line 3. . .

ers and earned more than $80,400, he had too

Type of Tax

to tax Tax rate

withheld

Social security

$80,400

6.2%

$4,984.80

much social security tax withheld. Tom figures

Where to claim credit for excess tier 1 RRTA

his credit of $235.60 as follows:

withholding. If you file Form 1040A, include

Railroad employees

Tier 1 railroad

the excess in the total on line 41. Write “Excess

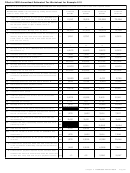

Filled-in Worksheet 3.1 for Tom Martin

retirement (RRTA)

$80,400

6.2%

$4,984.80

SST” and show the amount of the credit in the

(Example 3.4)

Tier 2 RRTA

$59,700

4.9%

$2,925.30

space to the left of the line. If you file Form 1040,

1. Add all social security tax withheld (but

enter the excess on line 62.

not more than $4,984.80 for each

You cannot claim excess tier 1 RRTA with-

Note. All wages are subject to Medicare tax

employer). This tax should be shown in

holding on Form 1040EZ.

withholding.

box 4 of your Forms W – 2. Enter the

total here. . . . . . . . . . . . . . . . . . . $5,220.40

Worksheet 3.3

Employer’s error. If any one employer with-

2. Enter any uncollected social security

held too much social security or RRTA tax, you

tax on tips or group-term life insurance

1. Add all tier 2 RRTA tax withheld (but

cannot claim the excess as a credit against your

included in the total on Form 1040, line

not more than $2,925.30 for each

income tax or file a claim for refund of the ex-

58 . . . . . . . . . . . . . . . . . . . . . .

0

employer). Box 14 of your Forms W – 2

3. Add lines 1 and 2. If $4,984.80 or less,

cess. Your employer must adjust this for you.

should show tier 2 RRTA tax. Enter the

stop here. You cannot claim the credit.

5,220.40

total here . . . . . . . . . . . . . . . . . .

4. Social security tax limit . . . . . . . . . .

4,984.80

2 Enter any uncollected tier 2 RRTA tax

Worksheet for Nonrailroad

5. Excess. Subtract line 4 from line 3. . .

$235.60

on tips or group-term life insurance

Employees

included in the total on Form 1040, line

58 . . . . . . . . . . . . . . . . . . . . . .

Worksheets for Railroad

3 Add lines 2 and 3. If $2,925.30 or less,

Unless you worked for a railroad during 2001,

stop here. You cannot claim the credit.

Employees

figure the excess on the following worksheet.

4. Tier 2 RRTA tax limit . . . . . . . . . . .

2,925.30

Worksheet 3.1

5. Excess. Subtract line 4 from line 3. . .

Publication 17 contains a worksheet on

1. Add all social security tax withheld (but

!

How to claim refund of excess tier 2 RRTA .

page 259 under How to figure the

not more than $4,984.80 for each

To claim a refund of tier 2 tax, use Form 843,

credit if you worked for a railroad. Do

CAUTION

employer). This tax should be shown in

Claim for Refund and Request for Abatement.

not use that worksheet if you are claiming a

box 4 of your Forms W – 2. Enter the

Be sure to attach a copy of all of your W-2 forms.

refund of excess tier 2 tax.

total here . . . . . . . . . . . . . . . . . .

2. Enter any uncollected social security

If you worked for a railroad during 2001,

tax on tips or group-term life insurance

figure your excess withholding on the following

included in the total on Form 1040, line

58 . . . . . . . . . . . . . . . . . . . . . .

worksheets.

3. Add lines 1 and 2. If $4,984.80 or less,

Worksheet 3.2

stop here. You cannot claim the credit.

4. Social security limit . . . . . . . . . . . .

4,984.80

1. Add all social security and tier 1 RRTA

5. Excess. Subtract line 4 from line 3. . .

tax withheld (but not more than

$4,984.80 for each employer). Social

Where to claim credit for excess social se-

security tax should be shown in box 4

curity withholding. If you file Form 1040A,

and tier 1 RRTA should be shown in

include the excess in the total on line 41. Write

box 14 of your Forms W – 2. Enter the

total here . . . . . . . . . . . . . . . . . .

“Excess SST” and show the amount of the credit

2. Enter any uncollected social security

in the space to the left of the line. If you file Form

and tier 1 RRTA tax on tips or

1040, enter the excess on line 62.

group-term life insurance included in

You cannot claim excess SST withholding on

the total on Form 1040, line 58 . . . .

Form 1040EZ.

Example 3.4. In 2001, Tom Martin earned

$48,000 working for the Shoe Company and

Page 36

Chapter 3 Credit for Withholding and Estimated Tax for 2001

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49