Form Ct-32-A - Banking Corporation Combined Franchise Tax Return - New York State Department Of Taxation And Finance - 2012 Page 10

ADVERTISEMENT

Page 6a CT-32-A (2012)

Legal name of corporation

Employer identification number

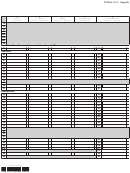

Schedule E — Allocation percentages

(continued)

Deposits maintained in branches within New York State:

152 Deposits of $100,000 or more .............................................................................................................................................................

153 Deposits of less than $100,000 ...........................................................................................................................................................

154 Deposits within New York State

........................................................................................................................

(add lines 152 and 153)

Deposits maintained in branches within and outside New York State:

155 Deposits of $100,000 or more .............................................................................................................................................................

156 Deposits of less than $100,000 ...........................................................................................................................................................

157 Deposits within and outside New York State

....................................................................................................

(add lines 155 and 156)

158 Percentage in New York State

...................................................................................................

(divide line 154 by line 157 in column E)

159 Additional deposits percentage

............................................................................................................

(enter percentage from line 158)

160 Total New York State percentages

............................................................................

(add lines 125, 150, 151, 158, and 159 in column E)

161 Taxable assets allocation percentage

........................................................................................................................

(see instructions)

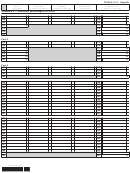

Schedule F — Computation of IBF adjusted eligible net income or loss

If the corporation has an IBF located in New York State, mark an X in the appropriate box below and see instructions.

The corporation computed ENI using the: IBF modification method

or

IBF formula allocation method

Computation of eligible gross income

162 Interest income from eligible loans .................................................................................................

162

163 Interest income from eligible deposits ............................................................................................

163

164 Income from foreign exchange trading and hedging transactions .................................................

164

165 Fee income from eligible transactions ............................................................................................

165

166 Eligible gross income

166

.............................................................................

(add lines 162 through 165)

Computation of applicable expenses

167 Direct expenses ..............................................................................................................................

167

168 Indirect expenses ............................................................................................................................

168

169 Total applicable expenses

.............................................................................. 169

(add lines 167 and 168)

Computation of ineligible funding amount

170 Eligible net income

) ............................................................................. 170

(subtract line 169 from line 166

171 Average aggregate liabilities and other sources of funds of the IBF which are not owed

to or received from foreign persons ............................................................................................

171

172 Average aggregate liabilities and other sources of funds of the IBF ..............................................

172

173 Divide line 171 by line 172 ................................................................................................................ 173

%

174 Ineligible funding amount

....................................................................... 174

(multiply line 170 by line 173)

175 Remaining amount

............................................. 175

(subtract line 174 from line 170; also enter on line 183)

Computation of floor amount and adjusted eligible net income or loss

176 Average aggregate amount of loans to and deposits with foreign persons in financial accounts

within New York State for tax years 1975, 1976, and 1977 ........................................................

176

177 Statutory percentage for the current tax year .................................................................................

177

%

178 Multiply line 176 by line 177 ............................................................................................................. 178

179 Average aggregate amount of loans to and deposits with foreign persons in financial accounts

within New York State (other than IBF) for the current tax year ..................................................

179

180 Balance

............................................................................................... 180

(subtract line 179 from line 178)

181 Average aggregate amount of loans to and deposits with foreign persons in financial

accounts of the IBF for the current tax year ...............................................................................

181

182 Enter 100 or the percentage obtained by dividing line 180 by line 181, whichever is less .............. 182

%

183 Remaining amount

183

................................................................................

(enter amount from line 175)

184 Floor amount

.......................................................................................... 184

(multiply line 182 by line 183)

185 Adjusted eligible net income or loss (

.................... 185

subtract line 184 from line 183; also enter on line 49)

421010120094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14