Form Ct-32-A - Banking Corporation Combined Franchise Tax Return - New York State Department Of Taxation And Finance - 2012 Page 14

ADVERTISEMENT

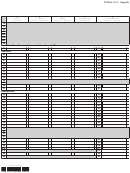

CT-32-A (2012) Page 9

of tax credits claimed on line 6 against current year’s franchise tax

Summary

Form CT-613 .....

Form CT-41 ...

Form CT-601.1

Form CT-631 .....

Form CT-43 ...

Form CT-602 ...

Form CT-633 .....

Form CT-44 ...

Form CT-604 ...

Form CT-634 .....

Form CT-238

Form CT-606 ...

Form DTF-624 ..

Form CT-249

Form CT-607 ...

Form DTF-630 ..

Form CT-250

Form CT-611 ...

Credit for servicing mortgages

(attach statement)

Form CT-259

Form CT-611.1

Other credits .....

Form CT-601

Form CT-612 ...

211 Total of credits listed above

(enter here and on line 6 indicating a negative total as such;

................................................................

211

attach appropriate form or statement for each credit claimed)

212 Total tax credits claimed on line 211 that are refund eligible

....................................

212

(see instructions)

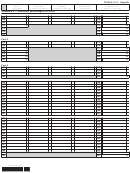

Amended return information

If any member of the combined group is filing an amended return, mark an X in the box for any items that apply and attach documentation.

Final federal determination ...............

If marked, enter date of determination:

Capital loss carryback .......................

Federal return filed .............Form 1139

Form 1120X .....

Net operating loss (NOL) information

New York State combined group NOL carryover total available for use this tax year from all prior tax years

Federal NOL carryover total available for use this tax year from all prior tax years ........................................

New York State combined group NOL carryforward total for future tax years ...............................................

Federal NOL carryforward total for future tax years ........................................................................................

Designee’s name

Designee’s phone number

(print)

Third – party

Yes

No

(

)

designee

Designee’s e-mail address

(see instructions)

PIN

Certification: I certify that this return and any attachments are to the best of my knowledge and belief true, correct, and complete.

Printed name of authorized person

Signature of authorized person

Official title

Authorized

person

E-mail address of authorized person

Telephone number

Date

(

)

Firm’s name

Firm’s EIN

Preparer’s PTIN or SSN

Paid

(or yours if self-employed)

preparer

Signature of individual preparing this return

Address

City

State

ZIP code

use

only

E-mail address of individual preparing this return

Preparer’s NYTPRIN

Date

(see instr.)

See instructions for where to file.

421014120094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14