Form Ct-32-A - Banking Corporation Combined Franchise Tax Return - New York State Department Of Taxation And Finance - 2012 Page 4

ADVERTISEMENT

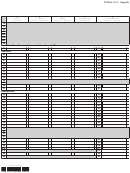

Page 3a CT-32-A (2012)

Legal name of corporation

Employer identification number

Schedule C — Computation and allocation of alternative ENI

60 ENI from line 57a

........................................................................................................................................................

(see instructions)

61 Interest income from subsidiary capital from line 45 ...........................................................................................................................

62 Dividend income from subsidiary capital from line 46 .........................................................................................................................

63 Net gain from subsidiary capital from line 47 ......................................................................................................................................

64 Interest income on obligations of New York State, its political subdivisions, and the United States, from line 48 .............................

65 Alternative ENI

................................................................................................................................................

(add lines 60 through 64)

%

66 Allocated alternative ENI

..............................................

(multiply line 65 by

from line 103, column E or line 121, column E)

67 Optional depreciation adjustments from line 58 ..................................................................................................................................

68 Allocated taxable alternative ENI

............................................................

(line 66 plus or minus line 67, column E; also enter next to line 2)

Schedule D — Computation of taxable assets

(see instructions)

69 Average value of total assets ...............................................................................................................................................................

70 Money or other property received from the FDIC, FSLIC, or RTC

.............................................................................

(see instructions)

71 Taxable assets

...........................................................................................................................................

(subtract line 70 from line 69)

%

72 Allocated taxable assets

..........................................

(multiply line 71 by

from line 150 or line 161; also enter next to line 3)

Net worth on last day of the tax year

73 Compute net worth ratio:

=

Total assets on last day of the tax year

.............................................................

Average quarterly balance of mortgages

74 Compute percentage of mortgages

=

included in total assets:

Average quarterly balance of total assets

.............................................................

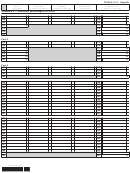

Additional information required

Are you a member of a federal consolidated group? ......................................................................................

Yes

No

If you answered Yes, complete items A through E.

A.

Number of corporations included in the federal consolidated group ......................................................

B. Total consolidated FTI before the net operating loss deduction (NOLD) .................................................

C. Total consolidated FTI before the NOLD of corporations that are included in the federal consolidated

return but that are not included in a combined return for New York State tax .....................................

D. Total FTI before the NOLD of corporations that are not included in the federal consolidated

return but that are included in a combined return for New York State tax ...........................................

E.

If 65% or more of the voting stock of the deemed parent corporation is owned or controlled, directly or

indirectly, by another corporation, enter the name and EIN of that corporation below.

Legal name of corporation

EIN

Mark an X in the box and attach Form CT-60-QSSS if any member of the combined group is the parent of a QSSS ..........

F.

G. Did you include a disregarded entity in this return?

.................................. Yes

No

(mark an X in the appropriate box)

If Yes, enter the name and EIN below. If more than one, attach list with names and EINs.

Legal name of disregarded entity

EIN

421004120094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14