Form Ct-32-A - Banking Corporation Combined Franchise Tax Return - New York State Department Of Taxation And Finance - 2012 Page 6

ADVERTISEMENT

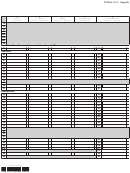

Page 4a CT-32-A (2012)

Legal name of corporation

Employer identification number

Schedule E — Allocation percentages

(see instructions)

Are you a banking corporation described in Tax Law section 1452(a)(9)? ......................................................... Yes

No

Are you substantially engaged in providing management, administrative, or distribution services to an

investment company as such terms are defined in Tax Law section 1454(a)(2)(G)? ...................................... Yes

No

If you answered Yes to both questions, then you must allocate using the receipts factor

.

(see Receipts factor in the instructions)

Part 1 — Computation of ENI allocation percentage

If you are claiming an allocation outside New York State, attach an explanation of the business carried on outside New York that gives you the right to allocate.

If the corporation has an IBF located in New York State, mark an X in the appropriate box below and see instructions.

or IBF formula allocation method

The corporation computed ENI using the:

IBF modification method

75 Wages, salaries, and other compensation of employees (except general executive officers) within New York State ........................

76 Multiply line 75 by 80% (.8) .................................................................................................................................................................

77 Wages, salaries, and other compensation of employees (except general executive officers) within and outside New York State ....

78 Percentage in New York State

) .......................................................................................................

(divide line 76 by line 77 in column E

Receipts during the tax period from within New York State:

79 Interest income from loans and financing leases ................................................................................................................................

80 Other income from loans and financing leases ...................................................................................................................................

81 Lease transactions and rents ...............................................................................................................................................................

82 Interest from bank, credit, travel, entertainment, and other credit card receivables ...........................................................................

83 Service charges and fees from bank, credit, travel, entertainment, and other credit cards ................................................................

84 Receipts from merchant discounts ......................................................................................................................................................

85 Income from trading activities and investment activities .....................................................................................................................

86 Fees or charges from letters of credit, traveler’s checks, and money orders ......................................................................................

87 Performance of services ......................................................................................................................................................................

88 Royalties ..............................................................................................................................................................................................

89 All other business receipts ...................................................................................................................................................................

90 Total receipts from within New York State

......................................................................................................

(add lines 79 through 89)

Receipts during the tax period from within and outside New York State:

91 Interest income from loans and financing leases ................................................................................................................................

92 Other income from loans and financing leases ...................................................................................................................................

93 Lease transactions and rents ...............................................................................................................................................................

94 Interest from bank, credit, travel, entertainment, and other credit card receivables ...........................................................................

95 Service charges and fees from bank, credit, travel, entertainment, and other credit cards ................................................................

96 Receipts from merchant discounts ......................................................................................................................................................

97 Income from trading activities and investment activities .....................................................................................................................

98 Fees or charges from letters of credit, traveler’s checks, and money orders ......................................................................................

99 Performance of services ......................................................................................................................................................................

100 Royalties ..............................................................................................................................................................................................

101 All other business receipts ...................................................................................................................................................................

102 Total receipts from within and outside New York State

.................................................................................

(add lines 91 through 101)

103 Percentage in New York State

......................................................

(divide line 90 by line 102, in each of columns A and E; see instructions)

104 Additional receipts percentage

..............................................................................................

(enter percentage from line 103, column E)

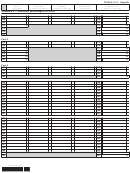

Deposits maintained in branches within New York State:

105 Deposits of $100,000 or more .............................................................................................................................................................

106 Deposits of less than $100,000 ...........................................................................................................................................................

107 Deposits within New York State

........................................................................................................................

(add lines 105 and 106)

(continued)

421006120094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14