Form Ct-32-A - Banking Corporation Combined Franchise Tax Return - New York State Department Of Taxation And Finance - 2012 Page 11

ADVERTISEMENT

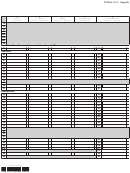

CT-32-A (2012) Page 6b

A

B

C

D

E

Parent

Total from

Subtotal

Intercorporate

Combined totals

corporation

member corporations

eliminations

(column A + column B)

(column C - column D)

Schedule E — Allocation percentages

(continued)

152

152

153

153

154

154

155

155

156

156

157

157

158

158

%

159

159

%

160

160

%

161

161

%

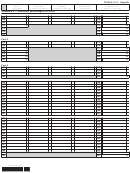

Schedule G — Computation of New York depreciation on certain property when method differs from federal

(see instructions)

Part 1 — Depreciation on qualified New York property acquired between January 1, 1964, and December 31, 1967

(Enter the description

of each property and date acquired; then complete columns C through H on the corresponding lines below)

A

B

Item

Description of property

Date acquired

A

B

C

D

E

C

D

E

F

G

H

Item

Cost

Federal depreciation

Federal depreciation New York depreciation New York depreciation

Undepreciated

prior years

this year

prior years

this year

balance

A

B

C

D

E

Totals

186 Add column E amounts

Combine this total with line 188, and enter on line 30.

187 Add column G amounts

Combine this total with line 192, and enter on line 58.

421011120094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14