Form Ct-32-A - Banking Corporation Combined Franchise Tax Return - New York State Department Of Taxation And Finance - 2012 Page 13

ADVERTISEMENT

CT-32-A (2012) Page 8

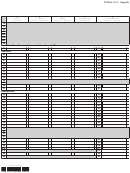

Method 3 — Computation of subsidiary capital allocated to New York State — Attach separate sheets displaying this information

formatted as below, if necessary.

Description of subsidiary capital

A — Description of subsidiary capital

(list the name of each corporation and the EIN here; for each corporation, complete columns B through G on the

corresponding lines below)

Item

Name

EIN

A

B

C

D

E

A

B

C

D

E

F

G

Item

% of

Average

Current liabilities

Net average

Issuer’s

Value allocated

voting

value

attributable to

value

allocation

to New York State

stock

of subsidiary

subsidiary capital

%

(column C – column D)

(column E × column F)

owned

capital

A

B

C

D

E

Amounts from attached list

194 Totals ....................................................................................... 194

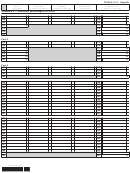

Method 3 — Computation of business capital allocated to New York State

195 Average value of total assets from line 69, column A ....................................................................... 195

196 Current liabilities

................................................... 196

(see instructions)

197 Total net average value of subsidiary capital from line 194, column E 197

198 Net business assets

............................................................. 198

(subtract lines 196 and 197 from line 195)

199 Enter the alternative ENI allocation percentage from line 121, column A ........................................ 199

%

200 Business assets allocated to New York State

........................................ 200

(multiply line 198 by line 199)

Method 3 — Computation of issuer’s allocation percentage

201 Subsidiary capital and business capital allocated to New York State

201

(add line 194, column G and line 200)

202 Total worldwide capital

............................................................................................ 202

(see instructions)

203 Issuer’s allocation percentage

203

%

. Enter here and on line 23 ........................

(divide line 201 by line 202)

Combined franchise tax

Composition of prepayments — Use the following worksheet to determine the prepayments of

franchise tax on line 12. If you need more space, write see attached here and enter all relevant

prepayment information on a separate sheet. Transfer the total to line 12.

Date paid

Amount

204 Mandatory first installment of combined group ..................................................... 204

205a Second combined group installment from Form CT-400 ...................................... 205a

205b Third combined group installment from Form CT-400 ........................................... 205b

205c Fourth combined group installment from Form CT-400 ........................................ 205c

206 Payment with extension request, from Form CT-5.3 ............................................. 206

207 Overpayment credited from prior years’ combined returns

...................................... 207

(see instructions)

Period

208 Overpayment credited from Form CT-32-M

.................................................... 208

209 Total prepayments from member corporations not previously included in the combined return

...................................................................................................................... 209

(from Forms CT-32-A/C)

210 Total prepayments

.............................................................. 210

(add lines 204 through 209; enter on line 12)

421013120094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14