Iowa Withholding Tax Booklet And Tax Tables - 2005 Page 10

ADVERTISEMENT

Iowa Department of Revenue

Find us on the Web at

contain the name, address and Federal employer identification number of the employer and the

name, address, Social Security number of the employee, the gross amount of compensation paid

to the employee during the year and the amount of Federal and State tax withheld.

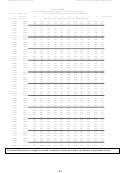

6. CALCULATION OF WITHHOLDING

Computer Formula

The State of Iowa offers two formulas, either of which may be used by withholding agents in

calculating the correct amount of Iowa tax to withhold from an employee’s paycheck. The

regular formula utilizes values for the actual pay period to calculate liability. The annualized

formula projects all values to an annual basis, then reduces the tax back to the amount due for the

pay period. For withholding agents who must calculate withholding for more than one length of

pay period, the annualized formula may be particularly beneficial. Round all amounts to the

nearest whole dollar.

Values of Variables used in the Formula

Standard Deduction Amounts

Pay Period

Number of Personal Allowances Claimed

0 or 1

2 or more

Weekly

$

28.85

$

69.23

Biweekly

$

57.69

$

138.46

Monthly

$

125.00

$

300.00

Annually

$

1,500.00

$

3,600.00

Tax Rate and Bracket Amounts

Rates

Weekly

Biweekly

Semimonthly

Monthly

Annually

0.0036 x 1st

$24.40

$48.81

$52.88

$105.75

$1,269.00

0.0072 x next

$24.40

$48.81

$52.88

$105.75

$1,269.00

0.0243 x next

$48.81

$97.62

$105.75

$211.50

$2,538.00

0.0450 x next

$122.02

$244.04

$264.38

$528.75

$6,345.00

0.0612 x next

$146.42

$292.85

$317.25

$634.50

$7,614.00

0.0648 x next

$122.02

$244.04

$264.38

$528.75

$6,345.00

0.0680 x next

$244.04

$488.08

$528.75

$1,057.50

$12,690.00

0.0792 x next

$366.06

$732.12

$793.13

$1,586.25

$19,035.00

0.0898 x remaining amount

9

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28