Iowa Withholding Tax Booklet And Tax Tables - 2005 Page 14

ADVERTISEMENT

Iowa Department of Revenue

Find us on the Web at

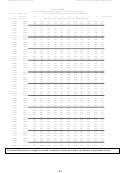

3. Using the correct table, select the wage bracket containing the amount of taxable

wages paid to the employee. Certain payments made by the employer into

employee retirement plans or for employee heath insurance are not considered

wages and are not included in the calculations of withholding tax.

4. Select the correct column for the number of personal allowances claimed.

5. Read across the row of the correct wage bracket and down the column of the

correct number of personal allowances.

6. Add to the amount at the intersection the additional amount of withholding

requested on the Employee’s Withholding Allowance Certificate (IA W4) Line 6

divided by the number of pay periods in a year.

WAGES OVER THE TOP BRACKET AMOUNT OF THE TABLE

Instructions

1. Subtract top bracket amount of wages from total taxable wages.

2. Multiply the result by 8.98 percent.

3. Add the tax amount over the top bracket to the tax amount from the table for the

top bracket amount.

4. The sum of these two is the amount to be withheld.

Example

Person earning $2,880 biweekly salary claiming three personal allowances.

$2,880 - $2,300 = $580 excess over top bracket.

$580 x 8.98% = $52.08.

$17.96 + $113.00 (withholding top bracket amount)

$165.08 total withholding. (Rounded = $165.00)

WAGES PAID DAILY

Instructions

1. Multiply daily wages by 10.

2. Find withholding amount on biweekly table.

3. Divide withholding amount by 10.

Example

Person earning $60 daily wages claiming two personal allowances.

$60 x 10 = $600.

Withholding on $600 biweekly wages equals $12.00.

$12.00 ÷10 = $1.20 withholding. (Rounded = $1.00)

BONUSES AND COMMISSIONS

Bonus paid during each pay period

If the bonus or commission is paid as a part of the regular pay during each pay period, simply

add the bonus to the regular pay and calculate withholding on the total payment.

Bonuses paid less often than regular pay

If a bonus is paid several times a year, but less often than the regular pay, the withholding on the

bonus or commission is calculated by annualizing the payment.

13

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28