Iowa Withholding Tax Booklet And Tax Tables - 2005 Page 18

ADVERTISEMENT

Iowa Department of Revenue

Find us on the Web at

Tax Year 2005

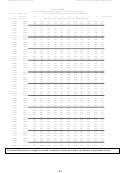

If The Payroll Period With Respect To An Employee Is W eekly

And The Wages Are

And The Number of Personal Allowances Claimed Is --

But Less

0

1

2

3

4

5

6

7

8

9

10 Or More

At Least

Than

The Amount Of State Income Tax Withheld Shall Be

680

690

31

30

28

27

27

27

27

26

26

25

25

690

700

31

31

28

28

28

28

27

27

27

26

25

700

710

32

32

29

29

28

28

28

27

27

27

26

710

720

32

32

29

29

29

29

28

28

28

27

27

720

730

33

33

30

30

30

29

29

29

28

28

27

730

740

34

33

30

30

30

30

30

29

29

29

28

740

750

34

34

31

31

31

31

30

30

30

29

29

750

760

35

35

32

32

31

31

31

31

30

30

29

760

770

35

35

32

32

32

32

32

31

31

30

30

770

780

36

36

33

33

33

32

32

32

31

31

31

780

790

36

36

33

33

33

33

33

32

32

32

31

790

800

37

37

34

34

34

34

33

33

33

32

32

800

810

38

37

35

34

34

34

34

34

33

33

33

810

820

38

38

35

35

35

35

35

34

34

34

33

820

830

39

39

36

36

35

35

35

35

35

34

34

830

840

39

39

36

36

36

36

36

36

35

35

35

840

850

40

40

37

37

37

36

36

36

36

36

35

850

860

40

40

37

37

37

37

37

37

37

36

36

860

870

41

41

38

38

38

38

38

38

37

37

37

870

880

42

42

39

38

38

38

38

38

38

38

38

880

890

42

42

39

39

39

39

39

39

39

39

38

890

900

43

43

40

40

40

40

40

40

40

39

39

900

910

44

44

41

41

40

40

40

40

40

40

40

910

920

45

44

41

41

41

41

41

41

41

41

40

920

930

45

45

42

42

42

42

42

42

42

41

41

930

940

46

46

43

43

42

42

42

42

42

42

42

940

950

47

46

43

43

43

43

43

43

43

43

43

950

960

47

47

44

44

44

44

44

44

44

44

43

960

970

48

48

45

45

45

44

44

44

44

44

44

970

980

49

49

45

45

45

45

45

45

45

45

45

980

990

49

49

46

46

46

46

46

46

46

46

45

990

1000

50

50

47

47

47

47

46

46

46

46

46

1000

1010

51

51

47

47

47

47

47

47

47

47

47

1010

1020

51

51

48

48

48

48

48

48

48

48

48

1020

1030

52

52

49

49

49

49

48

48

48

48

48

1030

1040

53

53

49

49

49

49

49

49

49

49

49

1040

1050

53

53

50

50

50

50

50

50

50

50

50

1050

1060

54

54

51

51

51

51

51

50

50

50

50

1060

1070

55

55

51

51

51

51

51

51

51

51

51

1070

1080

55

55

52

52

52

52

52

52

52

52

52

1080

1090

56

56

53

53

53

53

53

52

52

52

52

1090

1100

57

57

53

53

53

53

53

53

53

53

53

1100

1110

57

57

54

54

54

54

54

54

54

54

54

1110

1120

58

58

55

55

55

55

55

55

54

54

54

1120

1130

59

59

55

55

55

55

55

55

55

55

55

1130

1140

59

59

56

56

56

56

56

56

56

56

56

1140

1150

60

60

57

57

57

57

57

57

56

56

56

Compute 8.98 percent on wages in excess of maximum shown and add to last amount in applicable column.

Number of Pay Periods Per Year

Daily:

260

Semimonthly:

24

Weekly:

52

Monthly:

12

Semiannually:

2

Biweekly:

26

Quarterly:

4

Annually:

1

17

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28