Iowa Withholding Tax Booklet And Tax Tables - 2005 Page 27

ADVERTISEMENT

Iowa Department of Revenue

Find us on the Web at

FREQUENT QUESTIONS AND PROBLEMS

Does the State of Iowa assign its own employer identification number?

The Federal employer identification number is used as part of the Iowa withholding number with

a 3-digit suffix added for Iowa registration. This means you need to get your Federal Employer

Identification Number before getting your Iowa number.

I need to register to withhold Iowa tax from employees’ wages, but have not yet received

my Federal employer identification number. What will my number be?

Complete the Iowa Business Tax Registration form on paper or online. Choose "applied for" in

the "Federal I.D. Number" blank. The Department will issue a temporary identification number.

Once you receive your Federal identification number, it is your responsibility to notify the

Department of that number so your file can be updated.

I began withholding from employees but failed to properly register first. Tax is due shortly.

What should I do?

Complete the application and return it as soon as possible. Applying online is your fastest way.

Send a check for the amount withheld for the period to Withholding Tax Processing, Iowa

Department of Revenue, PO Box 10411, Des Moines IA 50306-0411. Include an explanation

showing your correct name, address, the period covered by the remittance, and your Federal

Employers Identification Number. The Department will process your application and credit the

amount paid to your account.

The due date for remitting tax has arrived and I am paying by check instead of

electronically, but I do not have a voucher to submit the tax. Is tax still due?

Yes. Tax is considered due even if no voucher is available. Remit the proper amount due with a

note showing your correct name, address, identification number, the period covered by the

remittance, your Federal Employers Identification Number, your eFile & Pay confirmation

number. Mail it to Withholding Tax Processing, Iowa Department of Revenue, PO Box 10411,

Des Moines IA 50306-0411.

Is the employer required to match the amount of Iowa income tax withheld from the

employees’ wages?

No. There is no matching of withholding of Iowa income tax from the employees’ wages.

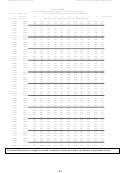

How is withholding calculated?

There are two methods of figuring the Iowa income tax withholding. The employer can use

either the manual tables or the computer formula. Either method is acceptable.

From where does an employer obtain W-2s, Iowa W-4s and Iowa W-4Ps?

IRS W-2s may be obtained from the Internal Revenue Service on the IRS Web site,

, by calling 1-800-829-3676, or by purchasing them through an office supply/forms

business.

Iowa W-4s (form no. 44019) and Iowa W-4Ps (form no. 44020) are available free of charge on

the Department’s Web site, , by calling 1-800-532-1531, or by fax at 1-800-

572-3943.

26

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28