Iowa Withholding Tax Booklet And Tax Tables - 2005 Page 11

ADVERTISEMENT

Iowa Department of Revenue

Find us on the Web at

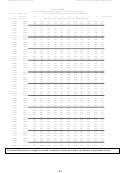

Credit Amounts

3rd and Each

1st Personal

2nd Personal

Subsequent Personal

Pay Period

allowance

allowance

allowance

Weekly

$0.77

$0.77

$0.77

Biweekly

$1.54

$1.54

$1.54

Semimonthly

$1.67

$1.67

$1.67

Monthly

$3.33

$3.33

$3.33

Annually

$40.00

$40.00

$40.00

Formula Examples and Instructions

Round all amounts to the nearest whole dollar

DEFINITIONS OF VARIABLES

G=Taxable Wages for Pay Period

R=Iowa Tax Rates

W=Federal Tax Withheld for Pay Period

C=Personal Allowance Credit

S=Standard Deduction

P=Number of Pay Periods

A=Additional Withholding Requested

N=Number of Personal Allowances

INSTRUCTIONS FOR REGULAR FORMULA

Items T 1 through T 4 represent the values derived at each step in arriving at the tax

to be withheld. Be sure to use the values for the correct pay period.

Subtract federal withholding from taxable wages. Certain payments made by the

employer into employee retirement plans or for employee heath insurance are not

considered wages and are not included in the calculations of withholding tax.

T 1 = G - W

Subtract the standard deduction from T 1

T 2 = T 1 - S

Multiply T 2 (taxable income) by the tax rates (1)

T 3 = T 2 x R

Subtract the personal allowance credits from the gross tax to arrive at final tax

liability

T 4 = T 3 – [ C x N ]

Add the additional amount of withholding requested on the employee’s IA W4

T 5 = T 3 + [ A ÷ P ]

10

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28