Iowa Withholding Tax Booklet And Tax Tables - 2005 Page 26

ADVERTISEMENT

Iowa Department of Revenue

Find us on the Web at

Calendar of Due Dates

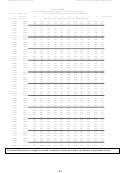

Semimonthly Filers - withholding of over $5,000 semimonthly ($120,000 per year)

Return for

Period of

Due Date

Period of

Due Date

January 1-15

January 25

July 1- 15

July 25

January 16-31

February 10

July 16-31

August 10

February 1-15

February 25

August 1-15

August 25

February 16-28

March 10

August 16-31

September 10

March 1- 15

March 25

September 1-15

September 25

March 16-31

April 10

September 16-30

October 10

April 1-15

April 25

October 1-15

October 25

April 16-30

May 10

October 16-31

November 10

May 1- 15

May 25

November 1- 15

November 25

May 16-31

June 10

November 16-30

December 10

June 1-15

June 25

December 1-15

December 25

June 16-30

July 10

December 16-31

January 10

Verified Summary

February 28

Monthly Filers - withholding of between $500 and less than $10,000 monthly and $5,000 or

less semimonthly (between $6,000 and $120,000 per year)

Return for

Period of

Due Date

Period of

Due Date

January

February 15

July

August 15

February

March 15

August

September 15

January-March Quarter

April 30

July-September Quarter

October 31

April

May 15

October

November 15

May

June 15

November

December 15

April-June Quarter

July 31

October-December Quarter January 31

Verified Summary

February 28

Quarterly Filers - withholding of less than $1,500 per quarter ($6,000 per year)

Return for

Period of

Due Date

Period of

Due Date

January-March

April 30

July-September

October 31

April-June

July 31

October-December

January 31

Verified Summary

February 28

NOTE: If the due date falls on a Saturday, Sunday, or Holiday, the return is due

on the next business day.

25

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28