Iowa Withholding Tax Booklet And Tax Tables - 2005 Page 25

ADVERTISEMENT

Iowa Department of Revenue

Find us on the Web at

Tax Year 2005

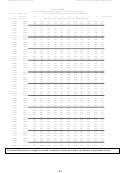

If The Payroll Period With Respect To An Employee Is Annually

And The Wages Are

And The Number of Personal Allowances Claimed Is --

But Less

0

1

2

3

4

5

6

7

8

9

10 Or More

At Least

Than

The Amount Of State Income Tax Withheld Shall Be

$

1 $

2000

0

0

0

0

0

0

0

0

0

0

0

2000

3000

4

0

0

0

0

0

0

0

0

0

0

3000

4000

10

0

0

0

0

0

0

0

0

0

0

4000

5000

25

0

0

0

0

0

0

0

0

0

0

5000

6000

49

9

0

0

0

0

0

0

0

0

0

6000

7000

74

34

0

0

0

0

0

0

0

0

0

7000

8000

117

77

0

0

0

0

0

0

0

0

0

8000

9000

160

122

0

0

0

0

0

0

0

0

0

9000

10000

200

167

32

0

0

0

0

0

0

0

0

10000

11000

241

212

77

37

0

0

0

0

0

0

0

11000

12000

281

256

122

82

42

2

0

0

0

0

0

12000

13000

322

296

167

127

87

47

7

0

0

0

0

13000

14000

363

342

212

172

132

92

52

12

0

0

0

14000

15000

418

397

257

217

177

137

97

57

17

0

0

15000

16000

473

452

303

270

230

190

150

110

70

30

0

16000

17000

528

508

359

331

291

251

211

171

131

91

51

17000

18000

583

563

414

393

353

313

273

233

193

153

113

18000

19000

638

618

469

448

414

374

334

294

254

214

174

19000

20000

693

673

524

503

475

435

395

355

315

275

235

20000

21000

748

728

579

558

536

496

456

416

376

336

296

21000

22000

803

783

634

614

593

557

517

477

437

397

357

22000

23000

860

841

689

669

648

619

579

539

499

459

419

23000

24000

916

899

744

725

705

683

643

603

563

523

483

24000

25000

971

958

802

783

764

744

708

668

628

588

548

25000

26000

1026

1016

861

841

822

803

773

733

693

653

613

26000

27000

1081

1072

919

900

880

861

837

797

757

717

677

27000

28000

1136

1127

977

958

939

919

900

862

822

782

742

28000

29000

1191

1182

1036

1016

997

978

959

927

887

847

807

29000

30000

1247

1239

1092

1075

1055

1036

1018

993

953

913

873

30000

31000

1304

1297

1147

1134

1115

1097

1079

1061

1021

981

941

31000

32000

1362

1355

1205

1195

1177

1158

1140

1122

1089

1049

1009

32000

33000

1420

1413

1262

1255

1238

1220

1201

1183

1157

1117

1077

33000

34000

1478

1470

1320

1313

1299

1281

1263

1244

1225

1185

1145

34000

35000

1536

1528

1378

1371

1360

1342

1324

1306

1287

1253

1213

35000

36000

1593

1586

1436

1428

1421

1403

1385

1367

1348

1321

1281

36000

37000

1651

1644

1494

1486

1479

1464

1446

1428

1410

1389

1349

37000

38000

1709

1702

1551

1544

1537

1526

1507

1489

1471

1453

1417

38000

39000

1767

1759

1609

1602

1594

1587

1569

1550

1532

1514

1485

39000

40000

1825

1817

1667

1660

1652

1645

1630

1612

1593

1575

1553

40000

41000

1882

1875

1725

1717

1710

1703

1691

1673

1654

1636

1618

41000

42000

1940

1933

1783

1775

1768

1761

1752

1734

1716

1697

1679

42000

43000

1998

1991

1840

1833

1826

1818

1811

1795

1777

1762

1747

43000

44000

2056

2048

1898

1891

1883

1876

1870

1862

1847

1833

1818

44000

45000

2116

2114

1956

1949

1941

1939

1937

1933

1919

1904

1889

45000

46000

2183

2181

2014

2011

2009

2007

2005

2003

1990

1975

1961

46000

47000

2250

2248

2080

2078

2076

2074

2072

2070

2061

2047

2032

47000

48000

2318

2316

2147

2145

2143

2141

2139

2137

2133

2118

2103

48000

49000

2385

2383

2215

2213

2211

2209

2207

2205

2203

2189

2175

49000

50000

2452

2450

2282

2280

2278

2276

2274

2272

2270

2261

2246

50000

51000

2520

2518

2349

2347

2345

2343

2341

2339

2337

2332

2317

51000

52000

2587

2585

2417

2415

2413

2411

2409

2407

2405

2403

2388

52000

53000

2654

2652

2484

2482

2480

2478

2476

2474

2472

2470

2460

53000

54000

2721

2720

2551

2549

2547

2545

2543

2541

2539

2537

2531

54000

55000

2789

2787

2619

2617

2615

2613

2611

2609

2607

2605

2602

55000

56000

2856

2854

2686

2684

2682

2680

2678

2676

2674

2672

2670

56000

57000

2923

2921

2753

2751

2749

2747

2745

2743

2741

2739

2737

57000

58000

2991

2989

2820

2818

2817

2815

2813

2811

2809

2807

2805

58000

59000

3058

3056

2888

2886

2884

2882

2880

2878

2876

2874

2872

59000

60000

3125

3123

2955

2953

2951

2949

2947

2945

2943

2941

2939

Compute 8.98 percent on wages in excess of maximum shown and add to last amount in applicable column.

24

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28