Iowa Withholding Tax Booklet And Tax Tables - 2005 Page 2

ADVERTISEMENT

Iowa Department of Revenue

Find us on the Web at

CHANGES FOR TAX YEAR 2005

Over the past several years, Federal individual income tax rates and brackets have changed. Both

Iowa and Federal tax brackets are indexed for inflation. This new withholding booklet is in

response to these changes and brings withholding calculation formulas and tablets up-to-date.

Changes are effective April 1, 2005.

Since the amount of withholding from wages will change, employees may want to revisit the

number of allowances they claim on their Iowa Employee Withholding Allowance Certificate

(IA W4).

1.

WITHHOLDING

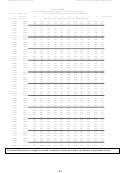

Iowa law requires that employers deduct and withhold from the wages an amount that will

approximate the employee's annual tax liability on a calendar year basis. The amount withheld is

calculated using tables or formulas provided in this booklet. Withholding agents are required to

remit the greater of the amount withheld, or should have been withheld, during the liability

period, as determined by the withholding agent’s filing frequency requirement. Filing frequency

thresholds are outlined in Section 5. Note that all withholding payments are to be the amount

withheld during the liability period. The amount withheld, based on formula or actual, must be

remitted to the Iowa Department of Revenue. No estimation or approximations are

permitted. Special rules exist for withholding from pensions, gambling winnings, and

supplemental wage payments. These rules are outlined in Section 4.

2.

WHO MUST ACT AS A WITHHOLDING AGENT?

Every employer who maintains an office or transacts business in Iowa and who is required to

withhold Federal income tax on any compensation paid to employees for services performed in

Iowa is required to withhold Iowa individual income tax from that compensation.

Registering as a withholding agent

To register, complete the Iowa Business Tax Registration form. If you have not yet obtained a

Federal I.D. Number, enter "applied for" in the "Federal I.D. Number" blank. The Department

will issue a temporary identification number. Once you receive your Federal Identification

Number, it is your responsibility to notify the Department of that number so your file can

be updated. Register online at or obtain the Iowa Business Tax Registration

form (78-005).

by mail: Tax Forms

PO Box 10457

Des Moines IA 50306

by phone: 515/281-7239 or 1-800-532-1531 (Iowa only)

by automated fax: 1-800-572-3943 (enter 0078005 when asked for form number)

to order by e-mail:

iowataxforms@idrf.state.ia.us

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28