Offer In Compromise Application - Tennessee Department Of Revenue Page 12

ADVERTISEMENT

CS-14B

Page 12

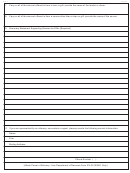

SECTION V - OBLIGATIONS

29.

Obligations

(Do Not Include Any Mortgages or Vehicle Loans)

Total Amount

Total Amount

Description

Description

Owed

Owed

$

Vehicle Leases

$

Notes Payable

Other Obligations:

Installment or Personal Loans

Education or Student Loans

Bank Revolving Credit

Judgments Payable

Past Due Federal Taxes

Past Due Other Taxes

$

TOTAL (Enter also on Page 3, Item 31)

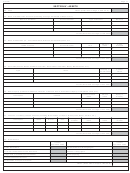

SECTION VI - NET WORTH CALCULATION

30. Assets

$

A.

Cash

B.

Bank or Credit Union Accounts

C.

Bank Credit Cards

D.

Securities

E.

Real Property

F.

Vehicles

G.

Other Assets

$

Total Assets

31.

Obligations

$

$

32. Net Worth (“Total Assets” Minus “Liabilities”)

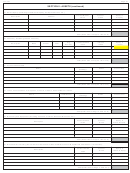

SECTION VII - OTHER INFORMATION

33. Are you currently in filing compliance with all Tennessee taxes?

[ ] Yes [ ] No If “No”, identify tax type and period:

34. If the tax liability was incurred in the operation of a business, has the business been discontinued?

[ ] Yes [ ] No Date discontinued:

35. Have you disposed of any assets or property by sale, transfer, exchange, gift, or in any other manner during the past 18 months?

[ ] Yes [ ] No If “Yes”, identify:

36. Is a foreclosure proceeding pending on any real estate that you own or have an interest in?

[ ] Yes [ ] No

37. Is anyone holding any assets on your behalf?

[ ] Yes [ ] No If “Yes”, identify:

Relationship:

38. Are you a party to any lawsuit now pending?

[ ] Yes [ ] No

39. Is there a likelihood that you will receive an inheritance within the next four years?

[ ] Yes [ ] No If “Yes”, from whom?

Relationship:

40. Have you previously petitioned the Department of Revenue for an offer in compromise for any tax liability?

[ ] Yes [ ] No

41. Are you or any business that you own currently under bankruptcy court jurisdiction?

[ ] Yes [ ] No Bankruptcy Case No.:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25