Offer In Compromise Application - Tennessee Department Of Revenue Page 2

ADVERTISEMENT

Page 2

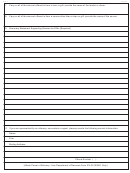

OIC-1 INSTRUCTIONS

OFFERS IN COMPROMISE: GENERAL INFORMATION

The Tennessee Department of Revenue's Offer in Compromise program allows a taxpayer to settle a tax

liability for less than the total amount owed. Generally, the Department will accept an offer in

compromise only if the amount offered represents the most the Department can expect to collect over

a 3-5 year time frame. The Attorney General and Reporter and the Comptroller of the Treasury must

approve compromises over a certain amount.

Basic Requirements. The Department will process an offer in compromise application only if the

taxpayer:

Is not the subject of an open or active bankruptcy case

Has filed all required tax returns and reports

Has fully completed the offer in compromise application

Has provided all supporting documentation

Has responded fully to all requests for additional information and documentation

Factors Considered. Although the Department evaluates each case based on its own unique set of facts

and circumstances, the Department gives the following factors strong consideration:

The taxpayer's ability to pay, both immediately and over time

The amount of equity in the taxpayer's assets

The taxpayer's income and allowable expenses

The potential for changed circumstances

The likelihood the taxpayer will comply with tax laws in the future

Whether a compromise is in the best interest of the state

The Offer. Generally, the amount the taxpayer offers must represent the maximum amount the

taxpayer can pay, either immediately or over a 3-5 year time frame.

The offer in compromise application includes a worksheet to assist taxpayers in determining an

acceptable offer.

Not all expenses are allowed. The Department utilizes federal guidelines for Tennessee to

determine allowable household and personal expenses. The Department will not allow excessive

expenses or expenses related to debts that would not have priority over the State’s tax lien in a

bankruptcy proceeding.

The Department recognizes that each taxpayer’s circumstances are unique. The taxpayer can

ask the Department to consider special circumstances that might affect the taxpayer’s ability to

pay (for example, a serious long-term illness).

The Department will give the taxpayer an opportunity to complete, supplement, or correct an

application where it appears the taxpayer made a good faith effort to provide all required

information and documentation.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25