Offer In Compromise Application - Tennessee Department Of Revenue Page 3

ADVERTISEMENT

OIC-1 INSTRUCTIONS

Page 3

If the Department believes the taxpayer can pay the full liability over time, the Department will

decline to compromise the liability but will generally work with the taxpayer to set up an

installment payment agreement.

While the Offer is Pending.

Unless the taxpayer is experiencing extraordinary financial difficulties, submission of an offer in

compromise application does not halt collection activity or alter the payment requirements of

any current installment payment agreement.

To avoid levies and other collection action, the taxpayer may request a short-term installment

payment agreement while the application is under review. The Department will allow

reasonable requests unless it determines there is an immediate collection risk.

Any payment made with the offer, or while it is being reviewed, will be applied to the

liability and credited toward the compromised amount in the case of acceptance.

Payments will not be refunded if the offer is declined or withdrawn.

The Department may file a state tax lien on the taxpayer’s property while the application is

under review.

Reasons for Rejecting an Offer. The Department generally will not accept an offer if:

The Department’s financial analysis indicates that the taxpayer can pay an amount greater than

that offered OR the taxpayer has the ability to pay the entire tax liability, either immediately or

on an installment payment agreement

The taxpayer omitted or undervalued income, assets, or other items of significance on the

application

The taxpayer has a history of regular or willful noncompliance with Tennessee’s tax laws

The tax liability is based on taxes that the taxpayer collected from customers but did not remit

to the Department

The taxpayer has a history of criminal tax fraud (conviction, guilty plea, or “nolo contendere”

plea)

Offer in Compromise Application.

All information and statements provided by the applicant are subject to verification and are

submitted under penalty of perjury.

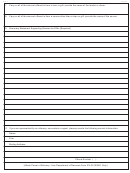

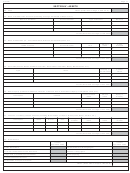

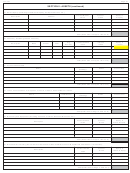

The taxpayer’s application must include the required financial disclosure form(s). Depending

upon the legal structure of the applicant, the following financial disclosure forms are required:

Individual applicants must submit Form CS-14B (Statement of Financial Condition for

Individuals)

Self-employed individuals and business owners must submit both forms CS-14B

(Statement of Financial Condition for Individuals) and CS-14C (Statement of Financial

Condition for Businesses)

Business entities must submit Form CS-14C (Statement of Financial Condition for

Businesses)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25